-

October 21, 2019 By :Shane McEwen

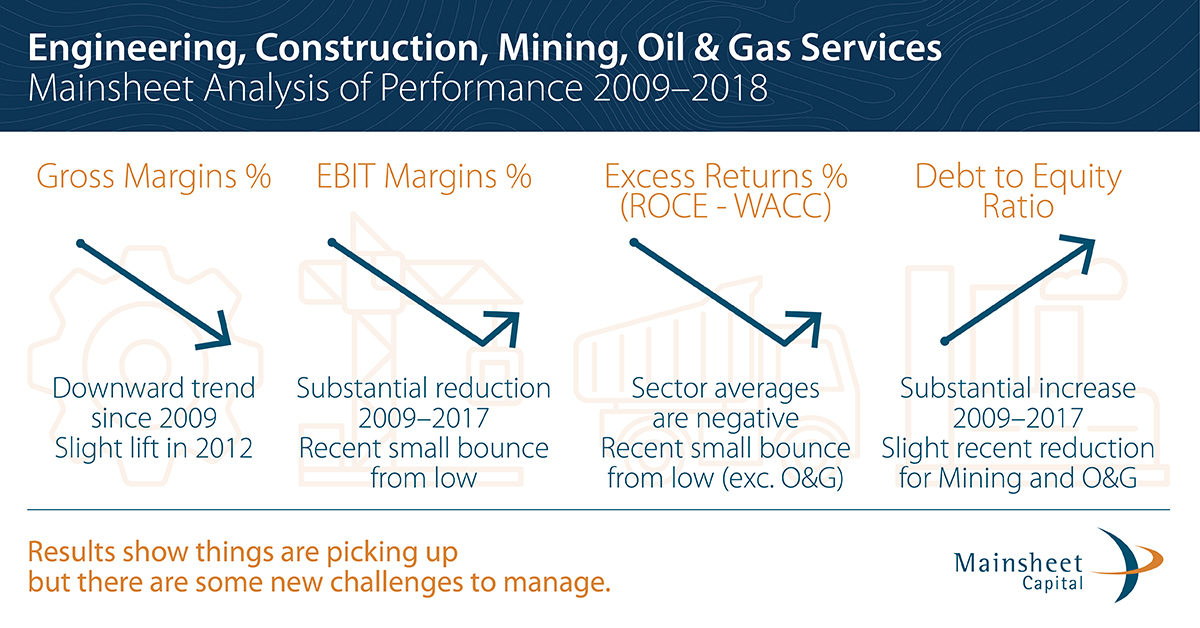

October 21, 2019 By :Shane McEwenEconomic Performance and Value Creation Analysis

Performance analysis of a sample of listed companies in construction, engineering, mining services and oil & gas services can be access through the links below

Read More

Categories

Recent Posts

- Optimising across the value chain

- M&A Success – Two Years On

- Operating Model Framework

- East Coast Energy Crisis

- Australia’s Grid: The Electrical Transition

- Defining Your Customer Strategy

- The Strategy Challenge

- Long-Term Value Creation Through M&A

- Energy Transition Drivers & Trends

- Operating Model Redesign – Why Do It?

- The Circular Economy for Wastepaper

- eCommerce, Transport & Logistics and the Last Mile

- Sustainability & ESG Reporting in the Resources Sector

- The Business Case for Displacing Diesel

- Successful Sale of 360 Environmental

- Lifestyle Hotels & Millennial Customers

- Pork Industry Changes

- Taking a Longer-Term View at M&A Performance

- Global Energy Shortage

- Plastic Replacement in Packaging

- Operating Model Redesign – 10 Fundamentals

- Waste Management and Recycling Changes and Opportunities

- Creating Value From Demergers

- Sustainable Development of Ports in Australia

- Is M&A Creating or Destroying Your Value?

- Energy Transition Changing Australia’s Export Commodity Mix

- Finding the Optimal Capital Structure

- Preparing for Change Following the Royal Commission into Aged Care

- Responding to the Sustainability Imperative

- Data-Driven Decision Making in the Water Sector

- Capitalising on a rapidly changing energy and carbon landscape

- Value Creation Challenges in Construction & Engineering

- M&A Performance in Australia

- Plant-Based Meat Substitutes on a Growth Trajectory

- Increasing Consciousness within the Personal Care and Hygiene Industry

- Future Scenario Planning

- Mining – Recent Growth Strategy Observations

- The Importance Culture and Organisation Design Plays in Delivering Strategy

- Commercial Due Diligence – Understanding Value in an Investment

- Mainsheet – Supporting our Local Manufacturing Industry

- M&A Performance in Australia

- Merger Announcement

- COVID-19 Prompting Digital Transformation

- Lessons from recent Mainsheet Operational Change & Transformation Projects

- Are B2B companies capturing the value of digital?

- Value Creation Challenges

- Positioning for Growth

- Economic Performance and Value Creation Analysis

- Recent M&A success – Exploring the impact of strategic rationale, relative size and frequency of deals

- Mainsheet Capital successfully advises Aurecon on its acquisition of Quartile One

- M&A Integration Model

- Scenario Planning

- Underperformance of recent market acquisitions highlights strategy and integration needs

- Mainsheet successfully leads the sale of MPC Group

- Mainsheet successfully advises Calibre Group on its acquisition of Diona