Taking a Longer-Term View at M&A Performance

When it comes to creating value from M&A, those companies that pursue multiple small- to medium-sized deals have a better chance of succeeding in the longer term.

We continue our series reviewing the financial performance of businesses following M&A activity by taking a longer-term view of potential value creation. While the potential for M&A to reduce value in the short term is well documented, our analysis shows that value creation substantially increases over the longer term if companies pursue multiple small- to medium-sized deals.

This quarter, we analyse the excess market growth of 78 Australian companies that announced a merger and acquisition in FY2011. We measure excess market growth as the difference in growth between the acquirerŌĆÖs market capitalisation and the value of the index that corresponds to the acquiring company. Although numerous factors other than the deal itself influence a companyŌĆÖs performance, the data presents an opportunity to better understand the likelihood of success following an acquisition. In addition, because we review financial performance over an entire decade, weŌĆÖre better able to understand the impact of longer-term acquisition strategies (including multi deal strategies) on value creation.

Findings

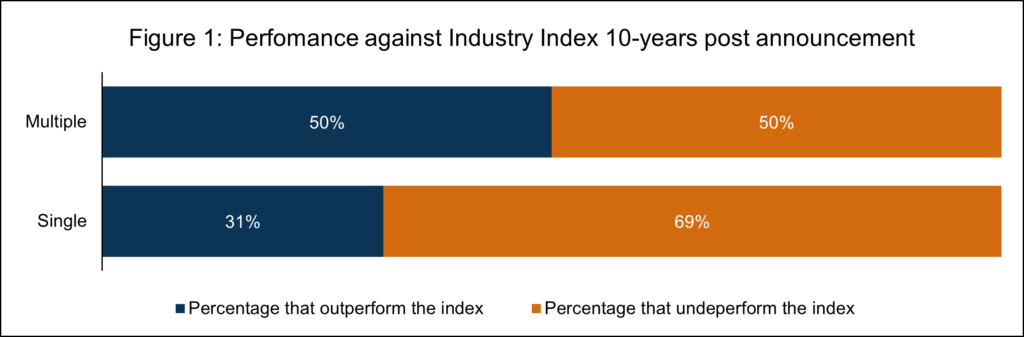

When segmenting the companies by deal frequency, the data showed that those companies that completed multiple deals had a better chance of succeeding over the long run (see Figure 1). This finding is consistent with analysis throughout MainsheetŌĆÖs M&A series.

This finding makes intuitive sense: experience plays a role in determining success. Identifying, negotiating, and integrating acquisitions, like any competency, are practised skills that need focus and development. Over time the capability becomes another core area of the business.

Moreover, this finding emphasises the benefits of a more deliberate and proactive M&A strategy instead of opportunistic M&A. It is crucial that acquiring businesses take a strategic and diligent approach to finding the right target. In todayŌĆÖs competitive market, opportunistic acquisitions are generally not the ideal approach. Instead, they should proactively identify gaps in their business and then build a pipeline of potential targets to fill these gaps and grow their business in line with their overall strategy.

The data also shows that the majority – 78% – of those that engaged in frequent M&A pursued deals that were small to medium in size (defined as those deals where the value of the transaction was 30% or less than the acquirersŌĆÖ market capitalisation). This finding is unsurprising given that a repeatable M&A strategy built around frequent smaller deals tends to be less risky than relying on frequent ŌĆśbig-bangŌĆÖ transactions.

Final Comments

The execution of a proactive and repeatable M&A strategy is not always easy. Value creation requires more than the completion of multiple small- to medium-sized deals. M&A and integration are critical business competencies where experience makes a difference, but building this capability requires time and commitment. However, with a well-defined strategy in place, and investment in the right internal and external expertise, an organisation can reap the potential long-term gains of successfully acquiring the right businesses.

If you are reviewing your M&A strategy and planning for acquisition-led growth, please contact us here.