Pork Industry Changes

Major ownership and structural changes appear to be underway in the Australian pork production and processing industry, with implications for different players along the value chain. In this article we summarise some of the recent and reported activity, provide an overview of the pork industry value chain and identify some of the potential considerations for different types of industry participants.

Industry Structure Changes

Structure change in the pork production and processing industry has been a recent topic following JBS’s announcement in June 2021 of its proposed acquisition of Rivalea, Australia’s second largest pig producer. Given JBS’s ownership of Primo, Australia’s largest smallgoods producer, the ACCC has outlined concerns of the potential for JBS to restrict supply of processing capacity and/or fresh pork, and is due to release its decision in December 2021. A range of other changes have also been occurring in the sector, or have been reported to be underway:

- September

2021: Media suggestions that privately owned SunPork may be looking to sell - June

2021: JBS announced its proposed acquisition of 100% of Rivalea - March

2021: NZ & Australian smallgoods business Hellers reportedly being sold by

Adamantem Capital - March

2021: SunPork acquired Little River Pork and Pig Co. to become the second largest

pig operator in VIC (as well as the largest in Australia) - August

2020: Woolworths announced plans to acquire a 65% interest in PFD Food

Services, a major foodservice distributor, signaling a new and strategic

channel for Woolworths’ meat business to market - August

2019: Swickers (part of SunPork) opened a $64m processing facility at Kingaroy

QLD

Pork Value Chain

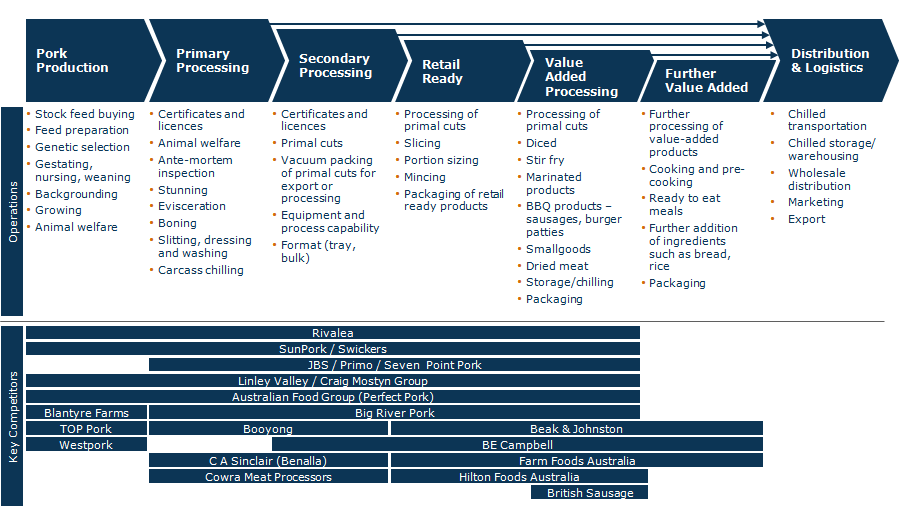

It is worth noting at this point that the pork value chain is complex, with value added at multiple steps, each with different optimisation considerations. There are also numerous models for participating across different aspects of the value chain. For example, a primary processor may have relationships with farms or own farms; it may or may not also perform secondary processing and produce retail ready or smallgoods; and the major retailers seek to engage strategically across the entire value chain to better manage quality and surety of supply.

JBS’s acquisition of Rivalea would represent one of the strongest models of vertical integration in Australia given Rivalea’s 42,000 sows (the second largest in Australia), the combined business’s three abattoirs (out of 7 with export accreditation) and Primo’s number one position in smallgoods.

Consumer Behaviour Changes

Substantial changes are also taking place in consumption trends and habits, in pork as well as across meat and protein generally.

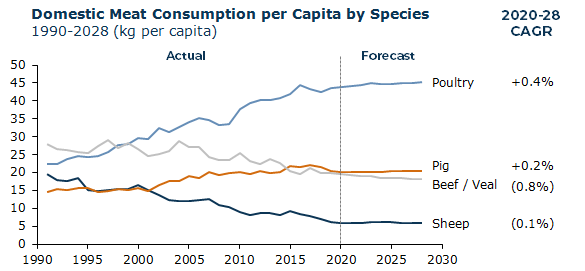

Consumption of beef and lamb have been in decline in Australia since the 1990s, in line with the World Health Organisation’s recommendation to eat less red meat, while consumption of poultry has increased substantially and pork has also grown, presenting an alternative healthy meat choice.

We are also seeing growth in products and services that combine convenience with fresh ingredients, and a related increase in home cooking. These services and business models were growing prior to COVID-19 but have been greatly accelerated through COVID-19 related lockdowns. HelloFresh, for example, said its sales had risen by almost 80% in the first six months of 2021, while an IRI Survey in November 2020 found that “66% of shoppers will create meals from scratch more often”. There has also been growth in value-added fresh grocery products such as preprepared roasts, grill products and BBQ products.

Consumers are also looking for sustainability credentials and animal welfare considerations, with growing consumer demand for free range meat production, organic meat products and plant-based meat alternatives.

Implications for Participants

The substantial changes underway in pork lead to a number of questions for participants to develop strategies and actions to respond to. These might include:

- Where

and how should we participate along the value chain to leverage our strengths

and maximise value? - What

is our customer value proposition for different segments of the market? - What

products, services and business models can we consider to meet changing

customer needs for convenience, fresh goods and quality products? - How

should we respond to industry changes to maintain or strengthen our competitive

position? - How

can we support and gain exposure to sustainably produced and healthy products? - How

should we engage with suppliers to support investment in efficiency while also

strengthening our competitive position?

If you would like to discuss any of these issues or opportunities further, we would be delighted to hear from you. Please contact us here.