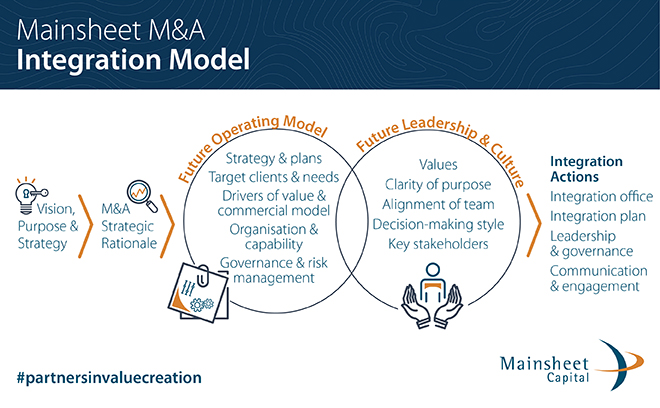

M&A Integration Model

Our article earlier this year analysing 2017 acquisitions showed that the old adage “~70% of acquisitions fail to add value” still proves true today. Yet when done right it can transform businesses and add shareholder value.

Will your next acquisition be part of that 70%? What can you can you do to make sure you’re in the top 30%? Here’s a few key points that may guide your M&A Integration:

- Acquisitions implement your strategy, they are not a strategy themselves.

- Acquisition strategy and target due diligence is the start of the integration process – start with the end in mind, not just the deal.

- Integration should focus on creating value from your new operating model and opportunities from core business and clients, not just from back office synergies to take advantage of scale.

- Integration effort needs expertise, time and leadership – it is not the same as running a business and doesn’t just happen.

We have each experienced poor integration – which has led us to further develop the Mainsheet M&A Integration Model. We plan to release a specific article on each of the elements over the coming months, so stay tuned for more…

If you have already commenced your M&A planning, have an acquisition target or are completing an acquisition and have a concern about your integration plan, please contact us here.