Long-Term Value Creation Through M&A

When it comes to creating value from M&A, our analysis identified that companies are more likely to realise value over the longer term.

We continue our series reviewing the financial performance of businesses following M&A activity by taking a more in-depth longer-term view of value creation. While the possibility for M&A to reduce the value of a company in the short term is well documented, our analysis shows that value creation substantially increases over the longer term. Relying on short term market reactions to gauge value creation underestimates the amount of value created by multi-deal strategies whose real worth develops over the longer term.

This report analyses the excess growth of a larger sample of 612 Australian companies that announced a transaction between FY2008 and FY2011. Consistent with our previous approach, we measure excess market growth for each acquirer as the difference in growth between the acquirers’ market capitalisation and the value of their corresponding industry ASX index. This longer-term analysis presents an opportunity to better understand the likelihood of success and compare distinct patterns of deal-making; however, it is important to note that other factors may influence excess market growth over time.

Overall Performance – a long game

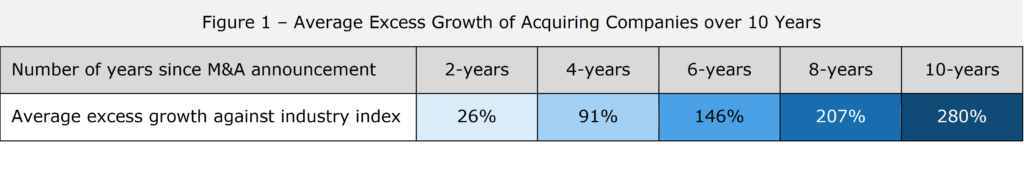

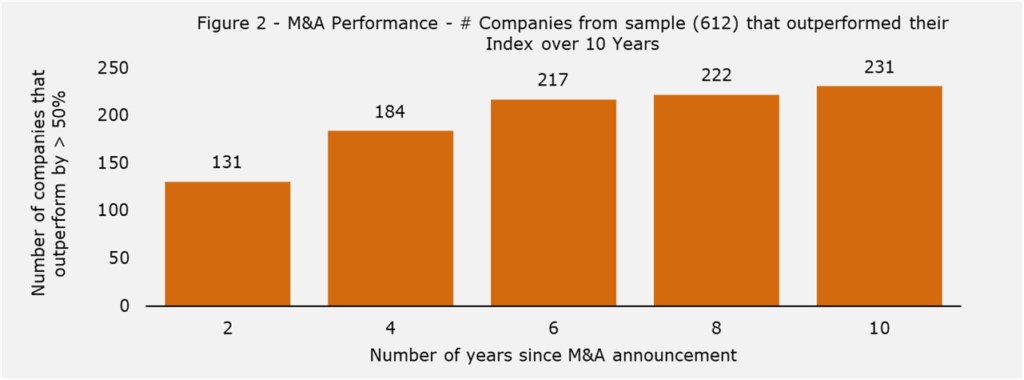

When it comes to creating value from M&A, our analysis suggests that companies are better able to succeed in the longer term. We found that the average excess growth of companies completing an acquisition increased with time. Two years after an acquisition, the average growth of all 612 companies was 26%, whilst the average lifted to 280% after 10 years (see Figure 1). Moreover, the number of companies that outperformed their respective industry index by more than 50% also increased substantially with time (see Figure 2).

M&A is one mechanism used by companies to create or enhance their competitive advantage through new value propositions. This 10-year analysis indicates that this competitive advantage tends to be realised over the long term, rather than short term.

Overall Performance – not for all!

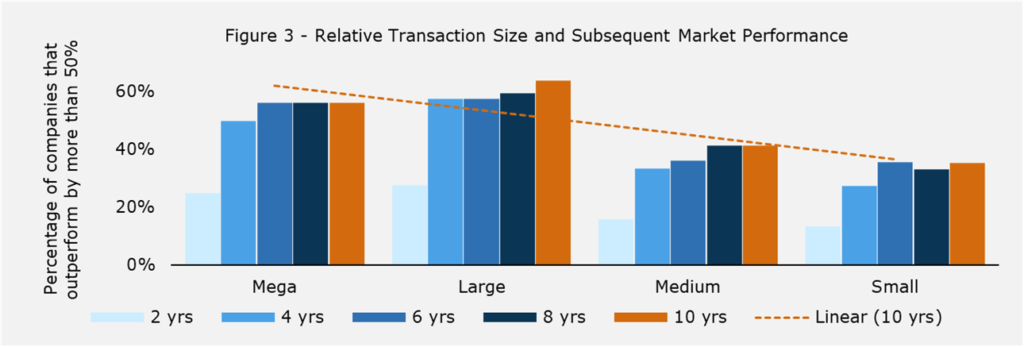

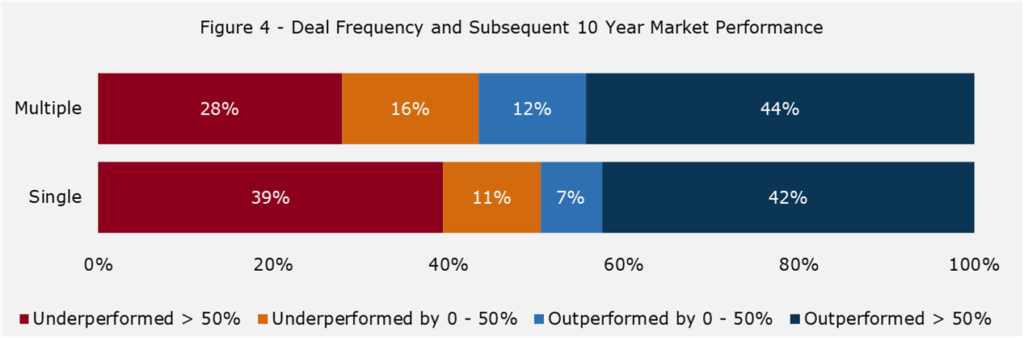

As compelling as averages appear to be, it does not mean all companies should expect value realisation in the longer term. When segmenting the companies by their M&A programs, we found that long-term returns vary significantly by deal size (Figure 3) and frequency (Figure 4).

Relative Size

We measure transaction size as the size of the transaction relative to the market capitalisation of the acquirer, which we allocate into four categories: small (< 5%), medium (5%-30%), large (30%-100%), and mega (> 100%). Consistent with our overall findings above, all companies, regardless of the size of the transaction they pursue, are more likely to succeed in the longer term. However, our analysis suggests that companies that pursue larger deals have the best chance of outperforming the market by more than 50% after ten years than those seeking small- to medium-sized deals (see Figure 3). This could reflect the more mature governance, processes, and management approaches of larger companies that were acquired.

Deal Frequency in the Year

We reviewed the 10-year performance of the number of deals in which companies performed acquisitions between FY2008 and FY2011 and found that those companies that pursued multiple deals were more likely to outperform their industry peers (see Figure 4). This would suggest that experience from previous M&A plays a role in determining post-deal success. M&A strategy, deal execution and integration, like any competency, is a practised capability for an organisation that needs focus, development, systems and people.

Final Comments

Ultimately, M&A can create value in the long term; however, value creation is contingent on a multitude of factors. It is often the case that synergies are not fully realised immediately upon acquiring the target. They require a clear strategy, leadership and integration plan with strong management expertise to reap long term value for shareholders.

If you would like to talk about these or other questions, please contact us here.