Increasing Consciousness within the Personal Care and Hygiene Industry

ŌĆ£What is really in the products I consume and use, and how did it get here?ŌĆØ

This question is being increasingly asked by consumers, with growing concerns about the naturalness and sustainability of the products we use every day. Historically, this has applied more specifically to food products, with consideration around the value of organic produce that is farmed relatively close to the end-consumer, with a transparent food-chain and traceable provenance.

Subsequently, this has translated into a significant rise in the profile of organic and natural foods, with Australian Organic estimating consumer demand for such food growing at 20-30% p.a., and more than six out of every ten households purchasing organic products.

This attitude is now spreading to other aspects of consumption, including personal care and hygiene, textiles, cleaning products, and pet care (with an estimated 1 in 10 households opting for organic pet care items!)

It is clear that Australians are becoming more conscious of what they are purchasing and consuming more broadly and this is translating into tremendous opportunities for companies that are willing and able to respond to these changing consumer needs.

Personal Care and Hygiene

Recently, Mainsheet was engaged by a leading player in the natural personal care and hygiene industry to design and enact an acquisition-led growth strategy to expand their categories and product lines.

The Australian personal care and hygiene industry market size is estimated at over $5.2b, with ~50% driven by makeup and skincare (including fragrances). Growth across the industry is expected to be quite flat, estimated at ~1.6% p.a. from FY21-26, given the maturity and commoditisation of the broader industry.

Despite the restrained growth across the broader industry, it is likely that organic and natural products will be a growth segment. The organic and natural segment, which accounts for ~10% of the total market, has grown by ~9% p.a. in the past 5 years and will likely continue to experience significant growth (with estimates ranging anywhere from 7-10% growth p.a.).

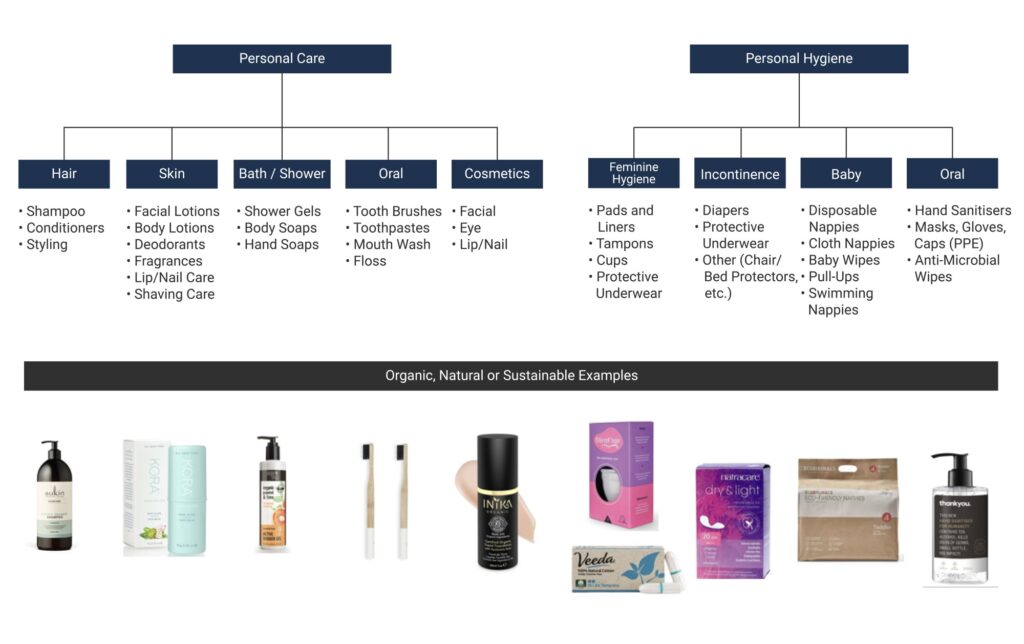

Given the breadth and depth of the personal care and hygiene industry (which ranges from cosmetics, shampoo and conditioners to sanitary napkins and baby nappies), there are clear examples of leading brands that are differentiating themselves through the lens of organic, natural and/or sustainable products.

Overview of Personal Care and Hygiene Market

Examples of players that have carved out a niche centred around being natural and sustainable include:

- Naturalness:

- Within the domestic feminine care industry, ~80% of market share is held by the top three players (with brands including U by Kotex, Libra, and Carefree/Stayfree).

- Increasingly however, players such as TOM, Veeda, and Cottons are differentiating themselves through the supply of chemical-free, and natural products.

- Demand for this niche was demonstrated through a 2019 survey conducted by Australian Organic, where ~50% of participants noted their motivation for purchasing organic products as concern for the impact on their personal health.

- Environmental Sustainability:

- An increasingly large concern within the feminine care industry has been the excessive amount of long-lasting landfill caused by disposable, non-biodegradable tampons and pads.

- In an Australian Organic survey, ~50% of participants noted their purchase motivation as concern for the impact their consumption has on the environment.

- With plastic components of pads taking ~500-800 years to degrade, compostable, biodegradable, plastic-free pads, and alternatives such as period pants (Modibodi, Thinx) and menstrual cups (Hello Cup, TOM, Lunette, etc.) have been rapidly growing ŌĆō growth estimates for period pants alone ranges from 10-30% p.a., as they become a solid, high-performing alternative to traditional pads and liners.

- Modibodi, an Australian-based leak-proof, apparel, underwear and swimwear maker, reported ~200% revenue growth p.a., from 2017-19, with private equity firm Quadrant taking a majority stake in the business.

- Social Sustainability:

- Another differentiator that has been used by brands is their level of social sustainability, or impact on the people and communities which are involved throughout the product lifecycle (from raw materials, processing, distribution, consumption, and waste).

- An exemplar of social sustainability within the domestic personal care industry has been thankyou, which produces natural skincare, bath/shower, and hygiene products. Their socially-focused mission of ŌĆśamplifying impactful change-makers to better serve people living in extreme poverty by redistributing wealth from consumer spendingŌĆÖ has strongly resonated with consumers, with their personal care brand growing by 40% in FY17.

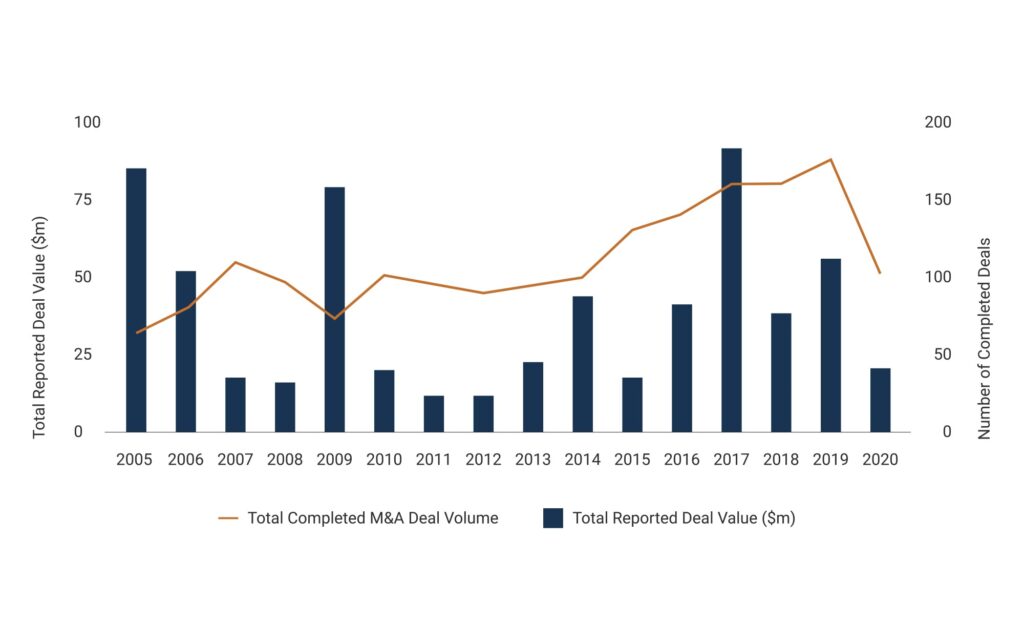

Transactions within the Global Personal Care Landscape

Across the broader, global personal care transaction landscape prior to COVID-19, we witnessed a steady increase in deal activity, with the number of completed deals rising from 104 in 2014 to a peak of 182 in 2019 and slowing back to 107 in 2020.

There has been a slight increase in the value of overall deals completed in the period from 2013 ŌĆō 2019 before slowing again in 2020. There was an substantial peak in 2017 of A$85b, which was driven by large deals such as LVMHŌĆÖs A$17b acquisition of Christian Dior.

M&A Activity in the Global Personal Care Industry

2005-20, ($m, completed deals)

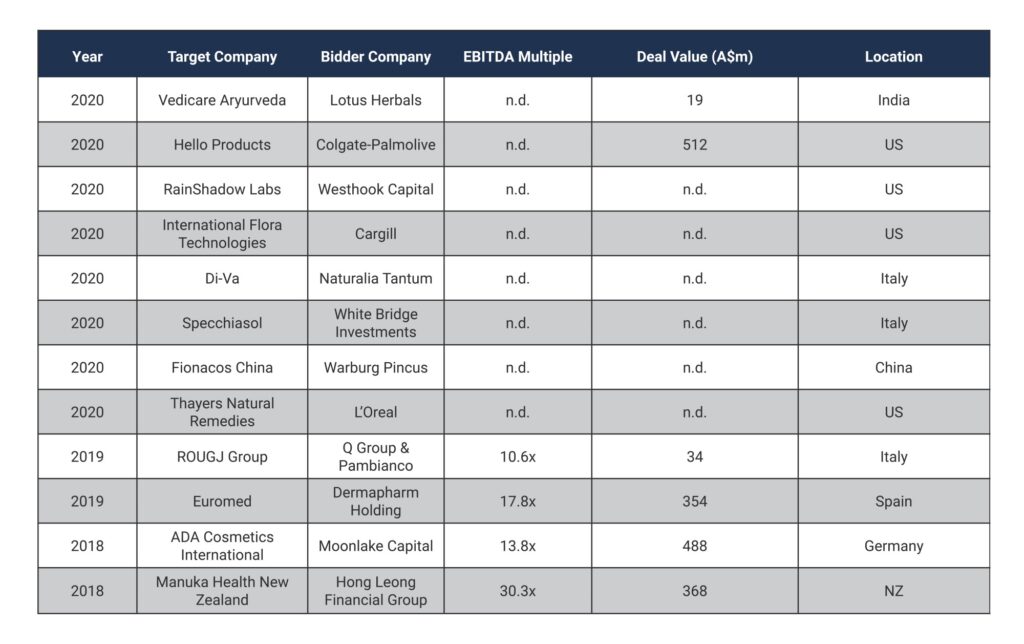

Within the organic and natural sub-sector of the personal care and hygiene space, there have been several deals globally. The two main drivers of investment appear to be:

- Large incumbents expanding into natural and organic adjacencies and geographies

- Global FMCG Colgate-PalmoliveŌĆÖs A$512m acquisition of Hello Products, a US-based, ŌĆ£naturally friendlyŌĆØ oral care manufacturer, was driven by the desire to enter the adjacent natural oral care market (toothbrushes, toothpastes, floss, etc.).

- ASX-listed wellness business BWXŌĆÖs A$102m acquisition of Andalou Naturals, a US-based natural skincare company, was driven by the desire to quickly gain access to a US distribution network to support the entry of other natural BWX brands into the US, extending upon AndalouŌĆÖs brand.

- Financial sponsors seeking attractive returns from natural and organic personal care companies

- US-based private equity firm Westhook CapitalŌĆÖs acquisition of RainShadow Labs, a private-label natural and organic personal care manufacturer, was driven by a strong investment thesis into the natural skincare and cosmetics industry

- Italy-based private equity firm White Bridge InvestmentŌĆÖs acquisition of Specchiasol, an Italian natural cosmetics producer, was aimed at gaining exposure to the natural cosmetics and herbal medicines space.

Select M&A Activity within the Global Natural and Organic Personal Care Industry

2018-2020

Conclusion

It is evident that sustainability and naturalness will continue to increasingly permeate the market, through new products and new start-ups who will be able to cater to these needs. Traditional incumbents will need to adapt to keep up with new players who are more connected with consumers ŌĆō whether through organic capability development, or inorganic acquisition.

If you would like to talk about this topic, or have any other questions, please contact us here.