Value Creation Challenges

in engineering, construction, mining and oil & gas services sectors

The increased activity in the engineering, mining services and oil & gas services sectors over the past six months is very welcome as analysis of the value creation performance over the past few years clearly shows that these sectors have been experiencing value creation challenges.

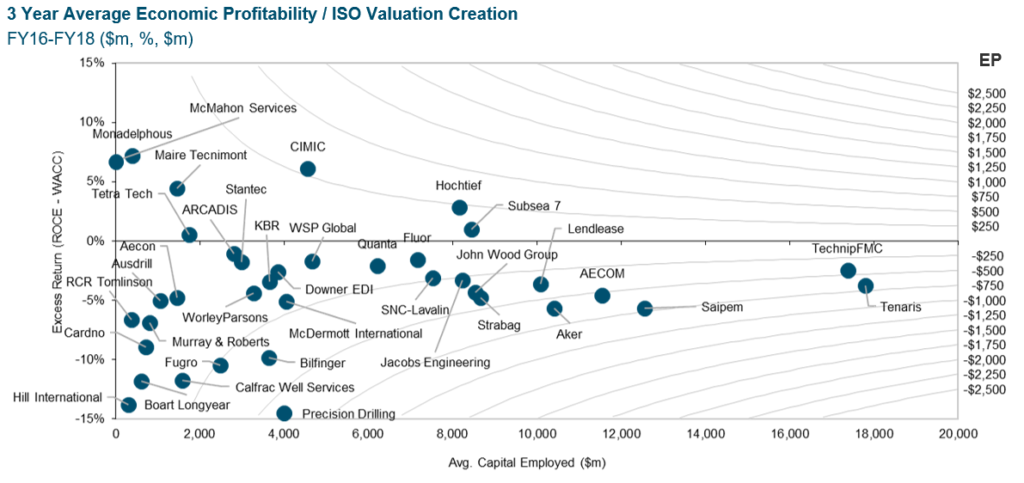

The chart below is an analysis of the 3-year average economic profitability (a measure of short term value creation) performance of companies in the engineering, construction, infrastructure management, mining services and oil & gas services sectors between 2016 and 2018 which is the latest full data set available. This analysis shows that most companies were not economically profitable and therefore did not create value across this period (i.e. for most companies the 3-year average return on capital employed [ROCE] minus their weighted average cost of capital [WACC] = negative result).

Source: Capital IQ, Company360

To understand more about this dynamic, Mainsheet has conducted additional research and analysis of performance in terms of individual companies, industry sectors, capabilities, company size, business model types (white collar, blue collar, etc.) and IP domains.

If you would like to see more of this performance analysis, then follow the link below to: https://www.mainsheet.com.au/economic-performance-and-value-creation-analysis/