Waste Management and Recycling Changes and Opportunities

Regulatory pressures and sustainability trends will disrupt the waste management industry, but will also present opportunities across the entire value chain. New regulations are expected to impact the industry significantly and pose challenges for companies in the sector. In a significant move, the Council of Australian Governments (COAG) has banned the export of waste plastic, paper, glass, and tyres, with a phased implementation over 2020-24 (with the mixed plastic export ban having just come into effect). Concurrently, many Asian countries have restricted the import of waste, including China, Indonesia, India, and other traditional destinations of Australian waste products. Locally, states and councils are introducing landfill levies, more strict waste disposal rules and waste reduction policies. Examples include the WA Plan for Plastics including a fast-tracked ban on single-use plastics, the NSW Government plan to cut single-use plastics and food scraps that end up in landfill, and levies introduced in 2019 that made trucking waste from NSW to QLD considerably more expensive.

However, such context can also present opportunities in waste management, especially considering sustainability trends. For example, recycling is expected to continue to grow, with an ongoing shift of waste from traditional landfill towards recycling and announcements by large corporations (Coca-Cola, P&G, etc.) of targets of 100% recycled materials in packaging. Also, energy recovery is expected to increase, with waste-to-energy technology providing renewable electric power to the national grid while reducing emissions and leachates from landfills. Organics and food waste recycling also have room to grow, recovering waste as compost (such as fertilisers for agriculture) and energy. In addition, the implementation of the circular economy announced by many governments will require building significant infrastructure and shifts across the Australian economy.

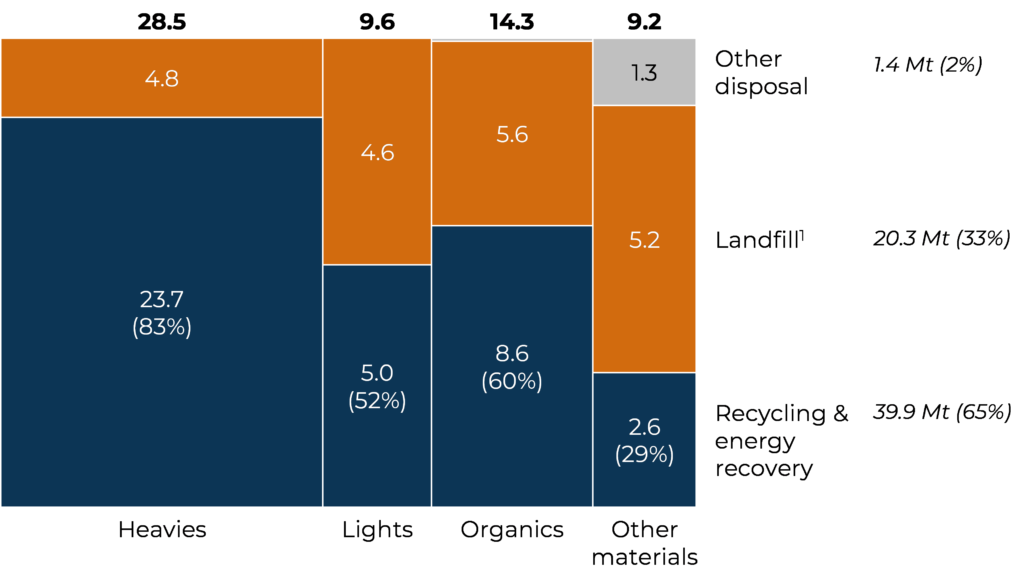

The data validates these sustainability-related opportunities. Of the 61.5 million tonnes of core waste produced by Australia each year, the recycling rate of lightweight waste (plastics, paper, cardboard, and glass) is relatively low at 52%, mainly due to the low recycling rate of plastics. Only 15% of Australian plastics waste was estimated to be recycled or used for energy recovery in 2018-19, compared to Germany’s 49%, Spain’s 51%, and the European Union average of 42%. Market constraints influenced by import restrictions in Asian markets led some waste companies to reduce the range of hard plastics accepted for recycling and many councils to essentially cease their early moves to collect soft plastics for recycling (with the recycling of soft plastics now heavily reliant on systems established by large supermarket chains). Also, most of the Australian energy recovery currently occurs in landfills since there are no large-scale waste-to-energy facilities in operation, with the first major one expected to go live in late 2021 in Kwinana WA. In addition, according to estimates from the Australian Organics Recycling Association (AORA), achieving a 95% recycling rate of organics could generate an additional $1.6b in supply chain opportunities and deliver over 4,000 jobs.

Australian waste generation by category and fate

2018-19, Mt (million tonnes)

Source: Department of Agriculture, Water and the Environment (2020 National Waste Report)

Successful players in the sector are leveraging these trends to navigate better the strategic considerations and choices in waste management, ultimately creating more value for their shareholders and society. Companies are increasingly investing in recycling, such as Cleanaway building a $35m PET plastic pelletising facility in Albury-Wodonga with joint venture partners. Veolia will manage and operate the thermal waste-to-energy facility going live in late 2021 in Kwinana, WA. Governments are also supporting investments in recycling capabilities, for example, the $35m grant by the SA Government to fund eight projects in the state, totalling $111m in investment. There is also increased M&A activity in the sector, including consolidation (such as the acquisition of SKM Recycling’s assets by Cleanaway in October 2019) and private equity investment (e.g. Mercury Capital acquiring a majority share in ResourceCo at a $300m valuation in December 2020).

In addition to these disruptions in the sector, waste management and recycling companies also constantly face strategic considerations and choices. For example, companies must decide how to optimise their asset base and capital allocation (e.g. truck fleet utilisation and route efficiency) or better capitalise on growing segments (energy recovery, organics, construction and demolition, etc.). Recent changes in the sector also highlight opportunities for investment and value creation. Mainsheet has extensive experience working with waste management, recycling, and other capital-intensive businesses and assisting them in accessing strategic growth options, capital investment decision-making, and transaction-related matters. If you would like to know more about how Mainsheet is helping companies in creating value in waste management or discuss the challenges you face in the sector, please get in touch with us here.