M&A Success – Two Years On

Mergers and acquisitions can offer a tremendous opportunity for achieving a companyŌĆÖs vision and strategic goals, but they can also be highly disruptive. To deliver the promised value, substantial changes to the merged organisationŌĆÖs operating model are often necessary, even if the intent is for it to operate as a standalone subsidiary.

Overall M&A Performance FY2020

As part of our regular M&A analysis series, Mainsheet analysed 228 non-resource1 ASX-listed companies that completed an acquisition in FY2020. Consistent with our previous approach, we measure excess growth for each acquirer as the difference in growth between the acquirersŌĆÖ market capitalisation and the value of their corresponding industry ASX index. Although numerous factors other than the deal itself influence a companyŌĆÖs performance, the data presents an opportunity to better understand the likelihood of success following an acquisition.

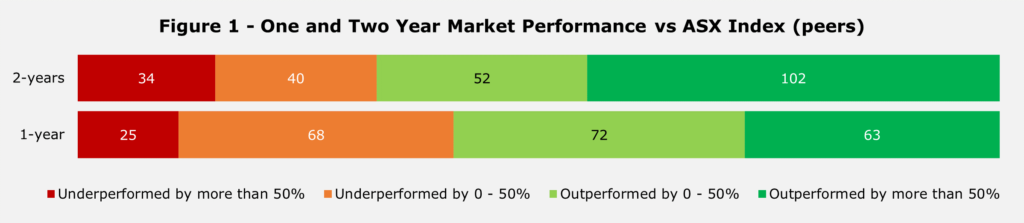

The median growth of the 228 companies against their benchmark over their one-year and two-year periods was 18% and 37%, respectively. Longer-term market performance, post-acquisition, outstrips performance after one year.

However, few companies were able to outperform their benchmark substantially. Less than one-third (63 out of 228) outperformed their respective index by more than 50% one year from the completion date of the acquisition, and less than half (102 out of 228) outperformed their index by more than 50% two years after (refer to Figure 1 for further detail).

Note that our analysis continues to exclude acquisitions in the Mining or Oil and Gas industry (251 in FY2020) because of the influence of commodity prices.

Maximising the Likelihood of Post M&A Success with an Operating Model Redesign

So, what does it take to be one of those companies that just beat their respective index or outperformed their index by more than 50% after a one-year or two-year period?

M&A is one of the most change-laden events within a business, where the future operating model changes substantially. So, when presented with an acquisition, to maximise the chance of value creation and alleviate the uncertainty, it is important to determine how the new organisation will operate by redesigning the combined companyŌĆÖs operating model, even if it is a light-touch approach.

An operating model provides a high-level view of how a companyŌĆÖs processes, people, data and technology interact to support the business. An operating model describes how a company develops and maintains the capabilities required to deliver its strategy and how it fulfils its stakeholder expectations.

The right operating model post-acquisition will optimise operations and enable management to deliver the promised value of the acquisition. It can ensure not only a more positive outcome for the integration but also for the future success of the combined entity. See our previous articles that discuss the fundamentals of and rationale for operating model redesigns in more detail.

Neglecting an operating model redesign during integration can expose the company to the following risks:

- Unnecessary cost ŌĆō An organisationŌĆÖs complexity and cost increases without alignment in

processes. This does not allow for economies of scale to be achieved; worse, it

can lead to substantial cost increases. We often see this in procurement and

overlap in ŌĆśmiddle companyŌĆÖ processes. - Poor decision making ŌĆō After two companies merge, decision-making rights and accountabilities

must be clarified. People want to know what is expected of them, what they are

accountable for, and their decision-making rights ŌĆō if companies do not deliver

on this, they risk not leveraging their best ideas, and missing out on

opportunities. - Negative customer experience ŌĆō Insufficient integration can hurt the customer. Customers

may be left to interface with separate brands rather than an integrated entity,

resulting in fragmented and frustrating customer experiences. - Losing

key talent ŌĆō Team members expect to be

kept up to date with aspects of the integration and deferring the vision could

lead to frustration. ŌĆśHow we will workŌĆÖ in a post-integration world is important

to individuals. Design of the future operating model provides this, rather than

just a change in organisation structure.

M&A Driven Operating Model Redesign Considerations

Whilst our operating model redesign process (see “Operating Model Framework”) holds for all companies across different industries, due to the nature of merging two separate entities, redesigning in the context of M&A requires organisations to:

- Understand the strengths and weaknesses of

each organisation ŌĆō In the context of M&A, the true strengths and weaknesses

of the organisations can be poorly understood or concealed. An M&A-driven operating

model redesign requires a concrete understanding of what each company brings,

the balance of strengths and weaknesses, and how the future integrated company

will deliver its intended deal value. - Design the future state operating model and roadmap ŌĆō Full implementation of

a new operating model rarely occurs on day one. The model on day one will look

very different from the end state model, and business units/functions will

progress at varying speeds. The design of the future state operating model sets

the vision, and the prioritised, sequenced and costed change plan provides the

roadmap for all stakeholders. - Embrace imperfection ŌĆō Due to the speed at which acquisitions occur, management

should be prepared to make operating model decisions with less than complete

information. It is often difficult to source all information before a

transaction is closed; however, you can get a considerable number of insights

from due diligence and deal analysis to start informing the design. - Ensure managerial oversight through the transition ŌĆō After the deal is closed,

we often see leaders stepping back and delegating the details to their teams. Acquisitions

can take up to 2 years to transition to the future state operating model. As

such, the executive team must continue to play an active role throughout the

transition phase in governance, decision making, stress testing and leadership

to ensure the intended value of the acquisition is delivered.

Implementing a new operating model post-acquisition will help ensure a more positive outcome for your integration as well as the combined entity’s future success. Mainsheet has deep experience in post-acquisition integrations and operating model redesign. To speak more about how we have assisted companies in such projects, please contact us here.