Value Creation Challenges in Construction & Engineering

Mainsheet regularly tracks the economic profitability of companies across a range of sectors. At the time of our analysis in 2019, we noted that there had been an increase in activity in construction and engineering after a prolonged period of value creation challenges.

However, in 2020 activity slowed down again due to the COVID-19 pandemic which created new challenges for these companies. Australian construction contractors were adversely affected by supply chain disruptions for construction equipment, building materials and skilled labour. Imported products such as component parts, building materials and construction equipment faced significant delays in production and shipment from China, Europe, and North America.

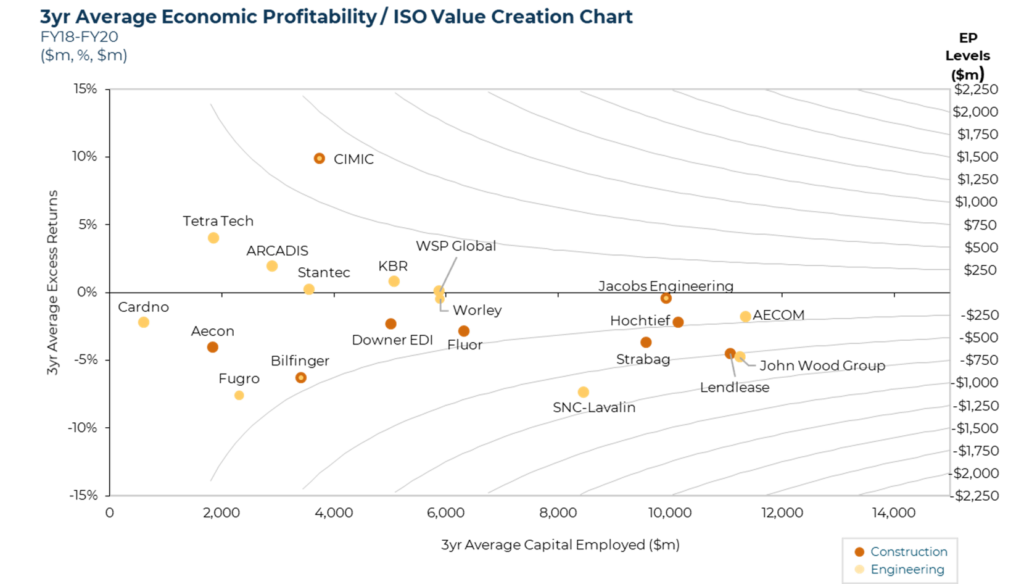

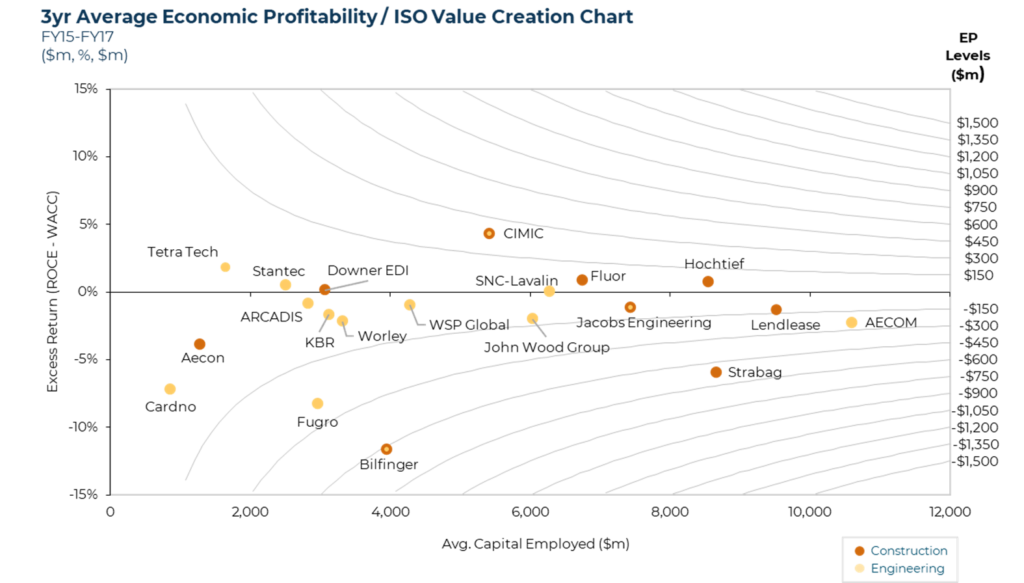

As a result, analysis of the three year average economic profitability (calculated as ROCE – WACC) between 2018-2020 compared to 2015-2017 shows little improvement in performance. The majority of Australian and international companies in these sectors have been economically unprofitable on average (i.e. three year average ROCE – WACC is negative and so not value creating) in both periods.

Source: Capital IQ, Company Websites

Although the overall theme is one of value creation challenges in the construction and engineering sectors over the two periods, we do note that there have been some positive movements. In particular, many of the lower asset base engineering companies have grown, improved value creation or moved from being economically unprofitable to economically profitable. Examples include Cardno, Tetra Tech, ARCADIS, KBR, and Worley. Meanwhile, most construction companies have struggled to achieve returns above the cost of capital in the highly competitive and low margin construction of major projects.

One thing this analysis supports is the important role that fiscal policy has to play through federal and state government infrastructure spending to stimulate economic recovery following COVID-19. It also highlights the need for major construction and engineering companies to strongly consider the need to optimise overheads, appropriately price contracts to account for risk and delivery challenges, and move towards scalable business models.

Mainsheet Capital has deep experience in construction, engineering, infrastructure management, mining services and oil & gas services. To speak more about how we have assisted companies to improve their economic profitability, please contact us here.