Underperformance of recent market acquisitions highlights strategy and integration needs

Mainsheet Capital analysed 16 ASX listed, industrial companies headquartered in Western Australia that completed an acquisition between December 2016 and January 2018.

Analysis reveals that most deals did not generate shareholder value for the purchasing company one year from the completion date of the acquisition. Comparable acquisitions completed since February 2018 follow a similar pattern.

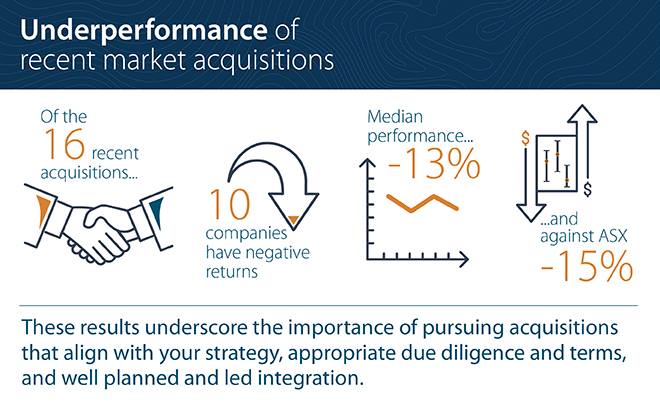

Ten of these 16 companies had negative returns one year from the completion date of their respective acquisition—11 underperformed the benchmark, the ASX 300, over the identical time period—and the median return of these 16 companies was negative 13%.

Additionally, the median performance of these companies against the benchmark over their one-year time periods was negative 15%.

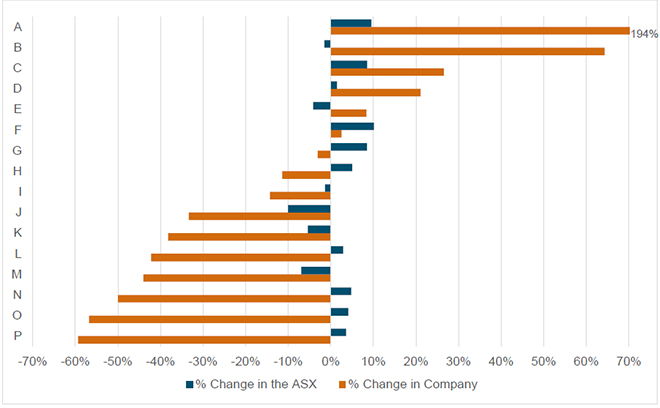

PERCENT CHANGE IN COMPANY ONE-YEAR FROM ACQUISITION COMPLETION DATE AND PERCENT CHANGE IN ASX 300 OVER IDENTICAL TIME PERIOD

* Note: Company A appreciated 194% one-year from the completion of its acquisition.

* Source: Capital IQ and Mainsheet Capital analysis March 2019

Of the five Western Australia-based, non-resource companies that have completed an acquisition since February 2018, their median return was negative 13% and their median underperformance against the ASX 300 was negative 8% through January.

A company’s strategy and strategy development, M&A strategy, target due diligence, acquisition/merger (merger) integration planning and execution may be factors of underperformance.

Gerard has lead or been involved in 5 integration projects in the last 7 years.

“In my experience working in post-merger integration there are many risks that, if not managed well, will lead to a drop in overall post-merger performance that includes:

- Leadership gaps and staff uncertainty

- Management distraction from operations and sales

- Missed market opportunities because of the internal focus

- Retained costs where synergies are not realised.”

Establishing a Project Management Office to manage the integration efforts oversees the leadership and communications coaching, risk management and captures the upsides of a merger. You can prevent being at the bottom of this list.

Are you considering growth via acquisition or merger? Have you just completed a transaction? If you want to talk about these or other questions, please contact us here.