M&A Performance in Australia

How do you maximise value from mergers and acquisitions?

Conclusions we have drawn from reviewing 387 Australian transactions completed in the last 3 years are supplemented by our learnings from strategy, M&A and integration client projects.

Following our January 2020 report on Australian M&A performance, we reviewed the one-year performance post-deal for 178 acquisitions completed during CY2019. We also examined the two-year share price performance of 149 firms that completed acquisitions in CY2018 and 60 firms that completed acquisitions in CY2017.

We are proud to continue this report series as we are able to draw on more transactions and a longer set of data. We acknowledge that there are other business events, other than M&A, that impact share price but we believe the right strategy, M&A planning and implementation has a significant impact on a business to make our observations worthwhile.

PERFORMANCE AGAINST INDUSTRY PEERS

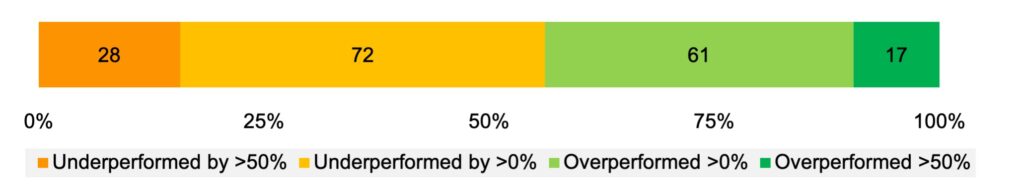

Our recent research suggests that, more often than not, stockholders of acquiring firms do not benefit in the immediate post-merger period. Among Australian acquirers, 56% underperformed against their industry benchmark one-year post-close, 72% underperformed after two years and 57% underperformed after three years.

FIGURE 1: 1YR PERFORMANCE AGAINST INDUSTRY PEERS

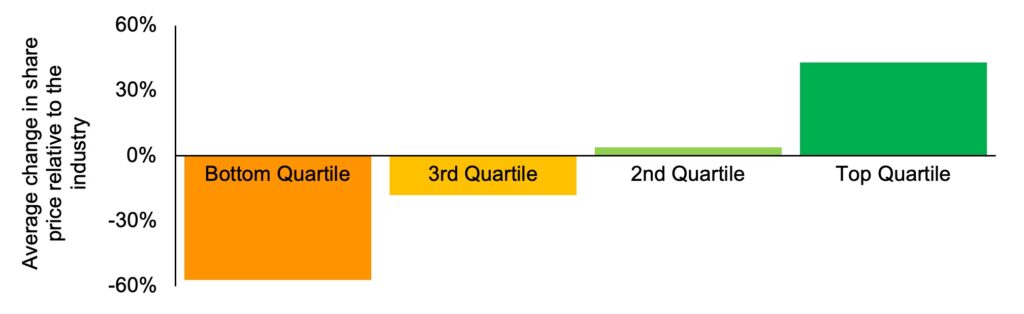

However, when done right, top-quartile acquirers outperform their industry peers on average by 43% one-year post-close (see figure 2). So, what does it take to be a top quartile performer? Here are a few points to help guide you.

FIGURE 2: AVERAGE QUARTILE 1YR PERFORMANCE AGAINST INDUSTRY PEERS

RELATIVE SIZE

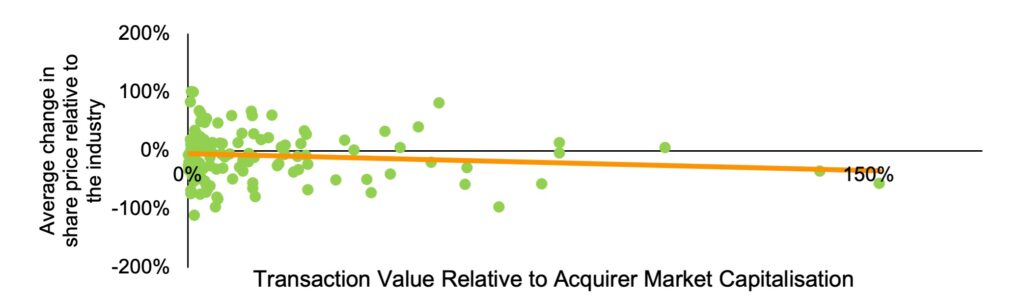

We measured relative size as the transaction value’s size relative to the acquiring firm’s market capitalisation. Figure 3 shows that the smaller the deal size relative to the acquirer, the greater the chance for outperformance against industry peers.

We believe smaller deals are likely to have a greater chance to outperform industry peers since post-merger integration is more manageable and, in like industries, there exists more scope for synergies. A merger’s success depends on having an effective integration process. However, crafting such a process tends to be the most challenging part of the M&A process.

FIGURE 3: RELATIVE TRANSACTION SIZE AND 1YR PERFORMANCE

AGAINST INDUSTRY PEERS

DEAL FREQUENCY

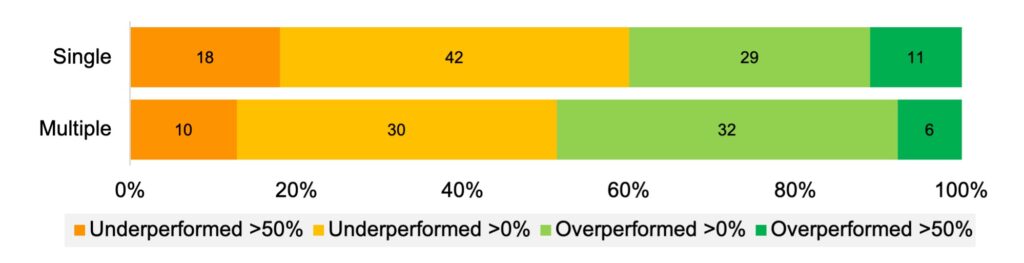

Figure 4 illustrates how companies that completed multiple acquisitions in CY2019 were more likely to outperform their industry peers in comparison to those who completed only one acquisition in CY2019.

This would suggest that experience from previous mergers and acquisitions plays a role in determining post-deal success. Integration, like any competency, is a practised skill that needs focus and development.

FIGURE 4: DEAL FREQUENCY AND 1YR PERFORMANCE AGAINST INDUSTRY PEERS

STRATEGIC RATIONALE

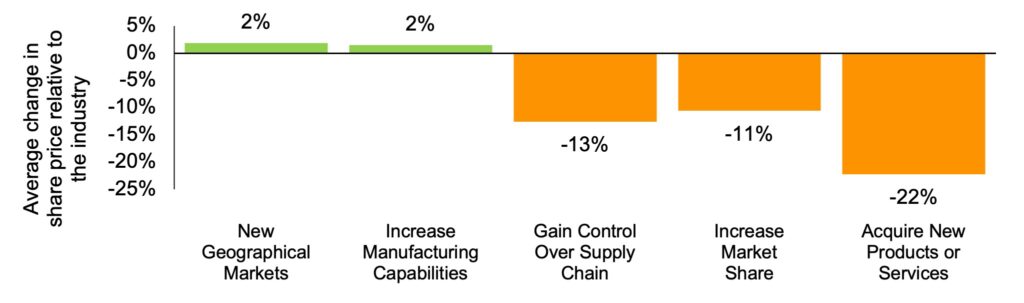

We reviewed company reports and press releases associated with each of the transactions and grouped the strategic rationale into one of five categories. Consistent with the findings reported in our previous study, which can be viewed on our website, companies that pursued transactions to acquire new products and services were least likely to create value in comparison to their industry. This is unsurprising given the research suggesting that the more you move away from your core business, the harder it is to succeed. This may also suggest that adding to the product or services portfolio may be increasing additional complexity across all management, operations and support functions that are not planned nor implemented well.

Acquisitions based on extending the reach of its products or services into a new geographic market or increasing manufacturing capabilities were most likely to create value.

FIGURE 5: STRATEGIC RATIONALE AND 1YR PERFORMANCE AGAINST INDUSTRY PEERS

HOW CAN MAINSHEET HELP MERGERS AND ACQUISITIONS CREATE VALUE?

Project Team Experience and Skills. M&A and integration are critical business competencies where experience makes a difference. Mainsheet can support clients by leveraging our in-depth industry knowledge and experience to maximise value creation throughout the M&A and post-merger integration process. In the past five years, our Sydney and Perth offices have worked on many successful client projects along the M&A continuum.

Comprehensive Integration Model. A carefully designed post-merger integration plan is crucial for M&A success. By leveraging and tailoring our standardised collection of processes, templates and protocols, we help our clients commit to a structured integration program to set up their integrated business for long term value creation.

Building a clear strategic rationale. Being clear on a deal’s strategic rationale is critical for both pre-and post-merger activities. A precisely defined purpose will help build a clearer understanding of the specific outcomes you want to achieve and how. Mainsheet can help firms with strategy development, M&A strategy, and deal searches, including expansions into new geographic regions and manufacturing capabilities. If you are thinking of commencing or improving your M&A process, please contact us for a conversation.

Thanks to Hazel Dutton in the Mainsheet Perth office for her lead on the analysis and insights from this study in our series.

If you want to talk about these or other questions, please contact us here.