Energy Transition Drivers & Trends

Major structural changes are underway across the traditional Australian energy sector, with sweeping implications for a wide range of industries. These changes, from fossil-based fuels to lower carbon alternatives, are just as much a result of voluntary company initiatives as they are of government intervention. Companies are increasingly setting ambitious emissions reduction targets, many of which require multi-layered approaches to achieve. The transition is fuelled by mounting societal pressures as well as cost efficiencies driven by technological improvements.

In this article, we summarise the drivers and dimensions of the energy transition, as well as the technologies and practices that will play the most significant roles in the future energy economy. The article will also provide an overview of some of the potential considerations that companies need to take into account at this inflection point.

WHAT IS CAUSING THE TRANSITION?

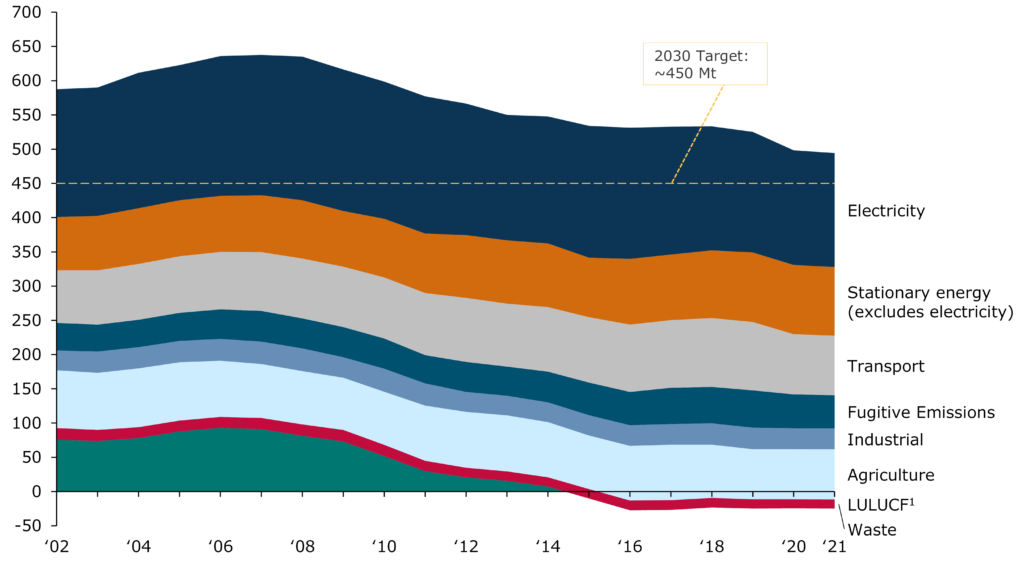

The energy transition is a prime focus globally in the context of ongoing climate change, given its large contribution to overall greenhouse gas emissions.

National Greenhouse Gas Emissions Breakdown

Emissions (Mt CO2-e)

Source: Department of Industry, Science, Energy and Resources (2021)

Australia’s energy consumption is largely dominated by the electricity, transport, manufacturing and mining sectors. The most significant changes are currently taking place in the electricity supply market, as technology costs have seen drastic improvements with the International Energy Agency (IEA) concluding in 2020 that solar power is now the cheapest source of electricity in history, with wind being close behind.

The electricity transition will largely focus on the generation of clean electricity from renewable sources including wind, solar and hydro, as well as the electrification of energy consumption. The transition has led to significant investments in Renewable Energy Zones (REZ), which house and connect energy generation projects (mainly large-scale wind and solar farms) with large-scale storage projects including utility-scale batteries and pumped hydro. This counteracts the variability of renewable energies and stabilises electricity prices.

Distributed energy resources (DER) and two-way power flows also play a crucial role in the transition. DERs are behind-the-meter small-scale units of local energy generation including rooftop solar PV units, battery storage, electric vehicle (EV) chargers, smart meters and home energy management technologies. The Australian Renewable Energy Agency (ARENA) estimates that by 2050 DERs may contribute up to 45% of Australia’s electricity generation capacity.

The electricity system must ensure that it all works together, with major upgrades required on a grid level to manage the changing generation mix, changing patterns in electricity demand, and integration of DERs.

Transport is also a sector of focus in the energy transition. As the costs of renewable electricity generation and green hydrogen production decline and the required infrastructure continues to be rolled out, EVs and hydrogen powered vehicles continue to become more attractive.

TRENDS

Stationary Energy

Various REZs have been identified across Australia for development, including:

- the NSW Government committing $380 million to developing the infrastructure for REZs in five locations (with one of the five zones drawing in $100 billion in expressions of interest to participate);

- the Victorian Government investing $682 million to fund six REZs; and

- the Queensland Government committing $145 million to support network upgrades, looking at three REZ corridors that span eight potential zones; and

- the WA Government committing $160 million to support the renewable hydrogen industry, giving Lead Agency Services to three projects including the Western Green Energy Hub, one of the world’s largest energy projects.

These REZs will connect the estimated $17 billion worth of renewable energy projects which are currently in construction, or due to start construction soon (this does not include figures for projects still in early stages of planning). The projects focus mainly on solar and wind farms, as well as their required energy storage, transmission and distribution infrastructure.

As for corporates, we are now also seeing an increasing number fast-track their process of installing their own DERs as well as sourcing renewable electricity from the grid, to power their operations and meet their emissions reduction targets. The energy transition in the manufacturing sector, however, remains in its infancy, as forecasts suggest that a shift towards powering key manufacturing sectors (steel, cement, ammonia and alumina) with hydrogen and clean electricity will require Australia to more than double its total electricity generation – an effort that will take time.

Mobile Energy

The battery electric vehicle (BEV) as well as fuel cell electric vehicle (FCEV) technologies are already being put in place in industries ranging from logistics to mining, with the transition expected to accelerate as the required infrastructure matures and the costs of renewable electricity and green hydrogen diminish. At this point in time, BEVs dominate the small vehicles market due to the lower costs of operating and the ability to charge on site or through growing charging infrastructure. Given the central role that machinery and equipment play in industrial operations, companies are being called upon, across their value chain, to help meet sustainability expectations. One key question business leaders face is when and how to transition from diesel to BEVs or FCEVs for heavy-duty vehicles, equipment and machinery intensive sectors. One argument is that FCEVs are currently the only zero-emission option that matches the service range, payload capacity and performance of diesel. However, the numbers suggest that BEVs remain the preference with the technology showing higher adoption rates than FCEVs and overall lower cost per kilometres.

CONSIDERATIONS

The energy transition poses substantial transformational challenges on businesses. With each company being tasked to assess the implications of a transition on its services, sourcing, assets, funding and financials – in the context of a limited public policy setting – focussed leadership is essential. Businesses will need to improve performance while managing supply and demand, energy efficiency, capital deployment and total cost of ownership for the various stages of the energy transition over the short, medium and long term.

If you would like to discuss the energy transition and its potential impact on your business and strategy in the immediate, medium and long term, please get in touch with us here.