Energy Transition Changing AustraliaŌĆÖs Export Commodity Mix

The global energy transition from fossil-based fuel to zero-carbon energy is driving significant change in AustraliaŌĆÖs mining sector and more specifically, AustraliaŌĆÖs export commodity mix. This transition is underpinned by the commitment (or at least the intention to commit) to net zero emissions by 2050 by many countries across the world.

The energy transition is being delivered in many forms, the largest of these being the use of wind, solar, hydrogen, geothermal and bioenergy to generate electricity. The other significant transition is the increasing use of electric vehicles and the growing adoption of decentralised energy generation and storage, specifically rooftop solar energy. A critical component across all of these green energy solutions is battery storage for surplus energy generated and for regulated energy supply when needed.

The Department of Industry, Science, Energy and Resources is forecasting Australian exports of commodities that are central to new and low emissions technologies to surge over the next five years. From an estimated $1 billion in FY2021, lithium exports are set to rise more than five-fold in real terms. Nickel exports are expected to almost double, while copper exports are set to increase by a third over the same period. Revenues from these three commodities combined are now set to exceed current thermal coal revenues by FY2026, as AustraliaŌĆÖs resources sector captures growth opportunities presented by new technologies and energy systems that are evolving.

Lithium

Lithium is a core input in the manufacturing of rechargeable batteries, with 46% of the global lithium production volume used for this purpose. World demand for lithium is estimated to increase from 305,000 tonnes lithium carbonate equivalent (LCE) in 2020 to 426,000 tonnes in 2021. Demand is then forecast to exceed half a million tonnes in 2022, and more than 1.0 million tonnes by 2026 as global electric vehicle (EV) uptake rises further driven by lower vehicle prices, government measures and increased model choice.

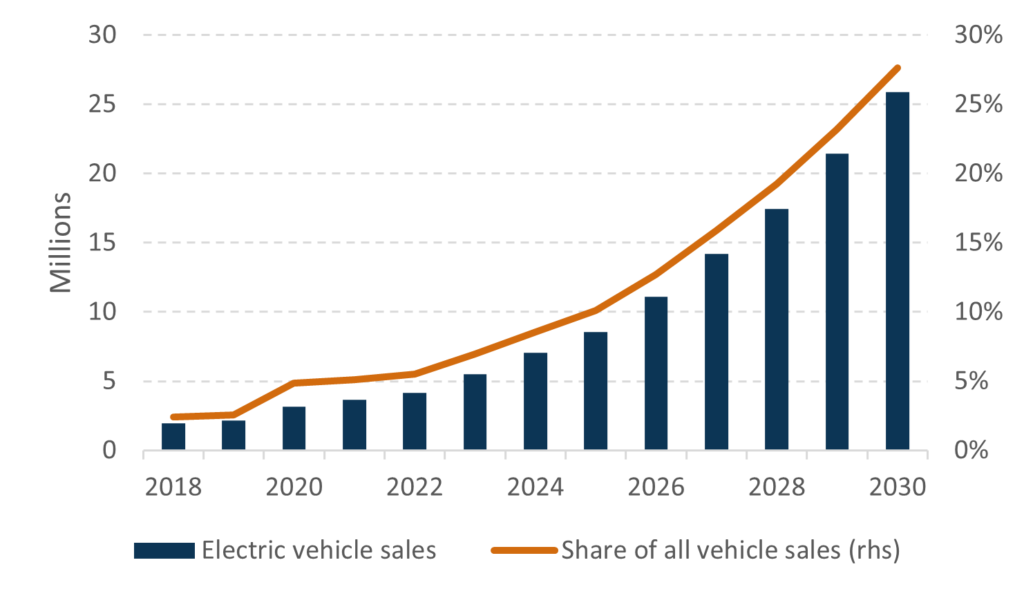

Electric vehicle sales are expected to increase from approximately 3 million in 2020 to 26 million by 2030, representing approximately 28% of all vehicle sales globally.

Australia is the largest exporter of lithium in the world, producing 49% of the worldŌĆÖs lithium in 2020. AustraliaŌĆÖs lithium production is projected to rise from 233,000 tonnes in FY2020 to 571,000 tonnes in FY2026, while export earnings (in real terms) are projected to increase from $1.1 billion to $5.4 billion over the same period.

Nickel

Currently around 60% to 70% of nickel consumption is used for manufacturing stainless steel, demand for which was impacted by COVID-19 related lockdowns. Going forward, growth is expected to be fuelled by returning levels of economic activity including consumption of stainless steel in manufacturing. Currently, only 5% of global nickel volume is utilised for manufacturing batteries, however this is expected to increase with increasing uptake of EVs.

Following a price collapse in March 2020 to US$10,800 a tonne, the nickel spot price has surged to US$20,110 a tonne in February 2021. Forecast market growth and speculative sentiment concerning a supply shortage for nickel required for EV battery production is expected to drive prices even higher, reaching US$23,000 a tonne in FY2026.

AustraliaŌĆÖs export volumes are forecast to rise from 201,000 tonnes in FY2021 to 246,000 tonnes in FY2026, however, further expansion in nickel production will be required for Australia to capitalise on the probable consumption expansion of commodities fuelling low-emission technology production. AustraliaŌĆÖs export earnings are forecast to increase from $3.8 billion in FY2020 to $6.5 billion in FY2026, driven by increased demand for AustraliaŌĆÖs higher quality nickel.

Copper

Copper is already a significant component in infrastructure and building construction, equipment manufacturing and industrial processes. Clean energy technologies are expected to put further pressure on global copper resources as it represents a critical raw material in the worldŌĆÖs path to net zero emissions. These technologies include renewable energy, electrification of transport, high speed rail, and new telecommunications networks.

China consumes half of the worldŌĆÖs copper and was the dominant driver of copper market tightness towards the end of 2020. Copper prices hit a record US$10,740 a tonne in May 2021 and the surge in prices has been two-fold: increasing demand driven by growing economic activity; and a stagnation in investment in new copper mines, depleting existing copper inventories. Some commodity analysts have predicted copper prices hitting US$15,000 to US$20,000 a tonne in the next 3 to 5 years if additional capital investment into new copper mine projects does not occur in the near term and estimates in scrap copper supply fall short of current predictions.

AustraliaŌĆÖs copper exports are projected to rise from 924,000 tonnes in FY2020 to around 992,000 tonnes in FY2026, with export earnings projected to lift from $10 billion to $16 billion over the same period, up by an average of 7% a year.

Big miners transitioning to ŌĆśfuture facing commoditiesŌĆÖ

The increasing investment into green energy commodities is not just being driven by the global energy transition, but also by a significant push by communities and governments for corporations, financiers and investors to deliver better social and environmental outcomes in addition to financial returns to their shareholders.

Both Rio Tinto and BHP have committed to achieving net zero emissions by 2050 and pledged a significant pool of funds to deliver on this commitment. Rio Tinto sold the bulk of its Australian coal mines between 2016 and 2018, and in 2020, BHP announced that the business was divesting nearly US$10 billion of carbon intensive assets with the company looking to invest more in ŌĆśfuture facing commoditiesŌĆÖ such as copper and nickel. In early 2021, Hancock Prospecting (Gina RinehartŌĆÖs flagship company), became the cornerstone investor for Vulcan EnergyŌĆÖs $120 million capital raising to develop a new lithium project in Germany, recognising the strong future lithium has in the uptake of EVs.

Further investment by bigger miners and consolidation in these commodity sectors is expected as future growth is targeted and delivered by current owners and operators.

Potential new growth opportunities for mining services providers

The changing mix in AustraliaŌĆÖs export commodities is creating new growth opportunities for mining and mining services companies, many of which are seeking to increase their exposure and build capability in these sectors. For example, AustraliaŌĆÖs largest freight rail operator, Aurizon, has recently stated its desire to leverage the changing commodity mix and capture growth opportunities to transport commodities including lithium, nickel, copper and cobalt.

How can Mainsheet assist?

Mainsheet has advised a number of mining and mining services clients looking to diversify into new sectors, and if you would like to discuss this area, please contact us here.