Plastic Replacement in Packaging

Mainsheet has recently assisted a leading Australasian packaging manufacturer and distributor with a review of domestic and international plastic replacement packaging markets ŌĆō with growth rates of 8-10% globally, and an estimated addressable size of $5-6bn in Australia alone[1].

As part of the review, Mainsheet identified potential opportunities to offer innovative solutions as well as to meet growing environmental, social, and consumer demands for sustainable packaging. In this article we outline the plastic problem, the alternatives, key trends, opportunities and insights for industry participants.

The Conventional Plastic Problem

Great BritainŌĆÖs Royal Statistical Society estimates that 8.3 billion tonnes of plastic have been produced globally since the 1950s. Furthermore, it estimates only 9% of plastic waste ever produced has been recycled, with the remaining 91% being incinerated or ending up in landfill and the natural environment, resulting in a significant global environmental challenge. Further research[2] estimates ~40% of plastic produced relates to packaging use, making it a significant focus of the conventional plastic problem.

Yet, plastic is a relatively new packaging material, with the first synthetic, non-biobased plastic, Cellophane, being introduced in the early 1900s by Swiss engineer Dr Brandenburg. In comparison, paper (in bark form) was used in China as early as 100-200BC to wrap food. In recent times, plastic packaging has come into the environmental spotlight as a problematic packaging material within the current state of infrastructure for a variety of reasons, including:

- Low

recycling rates ŌĆō According to the National Waste Report

2020, approximately 13% of plastic was recycled in FY19, as compared to the

recycling rate of 60% associated with paper and cardboard. The 87% of plastic that

was not recycled ended up in landfill and/or the natural environment.

Additionally, plastic can only be recycled 2-3 times before being unrecyclable

(due to shortening of polymer chains), whereas paper can be recycled up to 5-7

times. - Leakage

and pollution ŌĆō One of the advantages of conventional plastic

is that it is designed to withstand tough environments. This strength is also

its largest weakness (with PET estimated to take over 450 years to decompose,

as compared to the 2-6 weeks of paper). Combined with the low recycling rate, this

results in significant issues for the environment in the form of macro and

micro-plastic leakage. Subsequently, this impacts wildlife which may consume

plastic, and in turn, lead to the human consumption of downstream plastic,

resulting in various negative health outcomes.

Conventional Plastic Packaging Alternatives

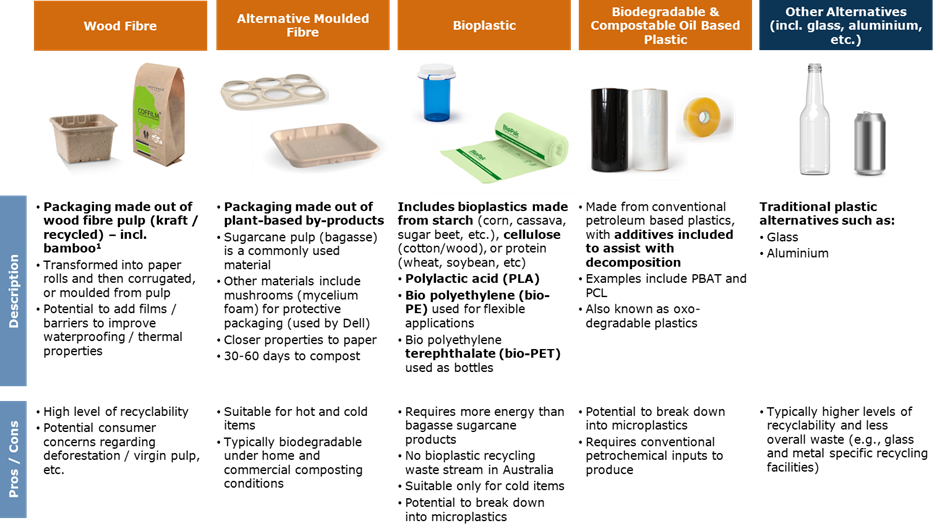

The problematic nature of plastic within the current infrastructure landscape has led to the rise of alternatives which utilise a variety of materials and additives, including wood fibre/pulp, sugarcane pulp (bagasse), mushroom (mycelium) and even crustaceans (chitin). The industry has also seen the rise of bioplastics such as PLA (made from starch or cellulose) and biodegradable/compostable petro-based plastics (with additives included to assist with decomposition ŌĆō noting concerns of microplastic leakage).

Examples of innovative replacements include:

- Fruit

punnets and trays: Adopted by suppliers of both Coles and

Woolworths, these punnets and trays are made of wood fibre pulp, or sugarcane

(bagasse). - Bread

clips: Tip Top announced the introduction of paper bread clips

in November 2020, with the goal of eliminating 100 million plastic bread tags

per year (or 35 tonnes). - Mushroom-based

EPS replacement: The largest application of mushroom-based

(mycelium) packaging relates to the replacement of EPS moulded foam. For

example, Mushroom Packaging has developed a mycelium-based foam which composts

in soil in 45 days, and grows in 7 days. - Protective

wrap: Plastic-based bubble wrap is quickly becoming replaced with

innovative and sustainable products such as HexcelWrap, a paper-based

hexagonal-woven paper wrap, gaining greater momentum in recent years.

Sustainable Packaging Trends and Insights

Mainsheet has identified four key tailwinds pushing the case for companies to address opportunities within the plastic packaging replacement market.

1. The Rise of the Eco-Conscious Consumer

Consumers across all generations are becoming more eco-friendly, but suppliers must balance consumer concerns regarding health and safety, price, and quality. According to the PwC Global Consumer Survey 2021, a majority of consumers are becoming more eco-friendly, with over 50% of millennials, Gen Xers, and baby boomers noting they intentionally buy items with eco-friendly packaging.

As a consequence of the COVID-19 pandemic, consumers are more concerned about their health and safety than the environmental impact of their purchases (with examples including face masks, paper towels, and gloves). Suppliers must also balance pricing (with eco-friendly products typically demanding a premium) and quality (with eco-friendly products typically being perceived as having lower performance in factors such as water resistance).

2. Increasing Focus on Corporate Social Responsibility

Increasingly, companies of all sizes are focusing more on their corporate social responsibility (CSR), through voluntary membership in industry associations such as APCO, who have set a 2025 National Packaging Target. This target includes using 100% reusable, recyclable or compostable packaging and phasing-out problematic single-use plastic packaging.

Additionally, large supermarkets such as Woolworths are increasing their focus on packaging, with the recent release of a preferred packaging materials list utilising a traffic light system (with hard to recycle plastics to be phased out by 2025).

Subsequently, there is an opportunity for players in this space to educate their customers on the value of sustainable packaging and to offer a compelling and differentiated packaging solution.

3. A Boom in Green Financing

There has been an increase in the availability of green financing options across all sources, including:

- Big 4

Banks: All big 4 banks have committed to increasing their

sustainable/green financing portfolio, ranging from WestpacŌĆÖs $25bn target by

2030, to Commonwealth Bank of AustraliaŌĆÖs $70bn target by 2030. - Government: The

Federal Government has committed $10bn to be deployed for emissions-reducing

investments, with funds such as the $200m CEFC Innovation Fund, and ARENA/

Southern Cross Venture PartnersŌĆÖ $200m Renewable Energy Venture Capital Fund. - Private

Equity / Institutional Investors: There are a number of

specialist ŌĆśgreen financeŌĆÖ funds, such as Artesian ($825m FUM across ESG

themes), as well as traditional investors who have increased their exposure to

green funds, such as Macquarie (via the GBP2.3bn acquisition of Green

Investment Group). - Crowdsourced

Funding (CSF): Start-ups have sought CSF via platforms such as

Birchal, with a notable example being the recently over-subscribed $5m

fundraising of closed-loop personal/home care products provider ZeroCo

(alongside Square Peg CapitalŌĆÖs $6m investment).

Subsequently, there are a range of financing options for players seeking to compete within this space, with a variety of trade-offs associated with each option. Conversely, investors and financiers must note the significant level of competition for sustainable packaging companies and ensure there is a strong case for value creation and return on investment.

4. Shift in Government Policies

State Governments have announced bans on various single-use plastic packaging categories (ranging from lightweight plastic bags and straws to plastic coffee cups). In parallel, the Federal Government has identified 8 problematic and unnecessary plastic product types to be phased out by 2025 (including plastic straws, lightweight plastic bags, stirrers, EPS food containers, etc.)

However, these announcements have focused largely on consumer-facing packaging (e.g., in the QSR packaging space), resulting in significant levels of competition amongst suppliers. Subsequently, there is an opportunity for suppliers to lead the transition in areas of less focus to gain a first mover advantage in areas such as industrial packaging.

How Mainsheet Can Assist

It is evident that there is significant opportunity within this growing segment for a variety of companies, ranging from existing packaging manufacturers to potential investors and financiers.

Mainsheet has demonstrable experience in assisting companies with the large-scale shift towards a sustainable future across various sectors. For companies seeking to understand their options, Mainsheet can assist in a number of ways, including:

- Working

with companies to develop sustainable portfolio and business unit strategies; - Assisting

companies in understanding strategic value creation options; - Reviewing

portfolio performance and future value creation prospects; - Assisting

with the sale and acquisition of businesses, divisions and assets to develop a

sustainable corporate portfolio (including strategy development, buyer/target

search, and transaction advisory support); - Restructuring

or refinancing of debt facilities, considering the various debt funding

solutions and financiers in the market; and - Developing

a capital investment plan to support growth initiatives.

If you would like to know more, please contact us here.

[1] Reflects an estimated potential opportunity size (incl. existing plastic market size) across select Fresh, FMCG, QSR, Industrials and eCommerce segments within Australia.

[2] Geyer, R., Jambeck, J. R., & Law, K. L. (2017). Production, use, and fate of all plastics ever made. Science Advances, 3(7). https://doi.org/10.1126/sciadv.1700782