Lifestyle Hotels & Millennial Customers

Hotel customers have evolved in recent years, with millennials seeking more unique and memorable experiences, giving rise to an international trend towards lifestyle hotels. Hotel brands are adapting their business models and offerings to respond to these changing consumer preferences, including strong customisation, affordable luxuries, social and community-building elements, as well as high reliance on digital marketing and guest experience. In this article we look at the lifestyle hotel trend globally, the extent to which it is also picking up in Australia, and outline some of the potential lessons and considerations for other businesses that serve the growing millennial segment.

Lifestyle Hotels

Lifestyle properties are typically slightly bigger than boutique hotels (e.g., up to 150 rooms) but still significantly more intimate than big-box chains. They aim to offer authentic designs, with many located in renovated heritage or local iconic buildings. In contrast to traditional hotels which are usually situated in CBD areas, they are often found in the suburbs, seeking to blend into their surrounding communities seamlessly and leverage what the neighbourhood has to offer. Many lifestyle hotels aim to innovate in facilities and entertainment while seeking to incorporate social elements and promote community building among guests, for example offering 24-hour bars, communal areas, and group classes. They also focus on a strong use of digital marketing, building a significant presence on social media and partnering with brands in other industries and digital influencers. They rely on apps and digital tools to optimise guest experience (for example, allowing guests to tailor their experience and book the entire trip on their smartphones).

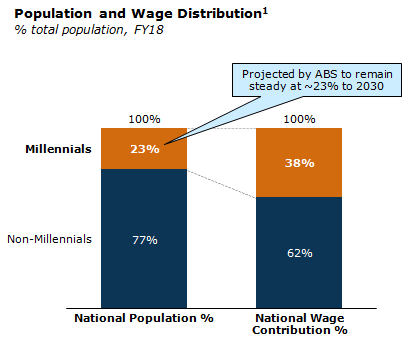

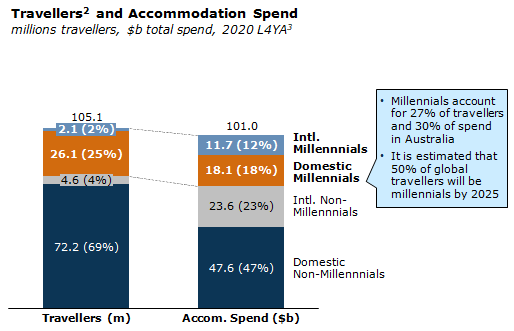

Many lifestyle hotels are targeted at the millennial demographic, although evidence suggests all age groups are using them. Catering to millennials makes sound commercial sense since millennials account for 23% of the Australian population while earning 38% of national wage, and 27% of the number of travellers while representing 30% of travel spend in Australia:

Millennial Consumer Preferences

Millennials are increasingly valuing unique guest experiences, affordable luxuries, and seamless digital services. For example, Macquarie Research (2017) found that ŌĆ£75% of Millennials are preferring to spend money on a desirable experience, education or ŌĆśshared goodŌĆÖ rather than a material possession ŌĆō and doing something different and uniqueŌĆØ. When travelling, those needs of millennials translate into unique expectations. For example, millennial travellers are seeking to experience memorable experiences (ŌĆśInstagrammableŌĆÖ moments) and explore destinations ŌĆślike a localŌĆÖ, valuing uniqueness over typical touristic attractions. In addition, younger travellers have different expectations and are more tech-savvy, looking to AirBnB and Uber rather than franchise hotels and taxis. As a result, standardisation is being less accepted, and it is becoming critical to personalise and tailor services to the needs and preferences of travellers. Additionally, in an age of mindfulness and remote work, more people are travelling alone or as ŌĆśdigital nomadsŌĆÖ, choosing to work while exploring different locations. These customer needs have been captured by lifestyle brand operators that adopt designs that evoke homeliness, promote informality, and cultivate communities. These brands also offer unique options for travellers, often through a highly customisable digital guest experience (e.g. virtual tours, chatbots, interactive information and maps, etc.).

Many major hotel groups have launched new lifestyle brands (e.g. AccorŌĆÖs 25hours and Mama Shelter or MarriottŌĆÖs W Hotels), aiming to combine elements of boutiques (small, intimate and modern offerings) and big chains (loyalty programs, distribution and economies of scale). There are also relevant global independent chains, including Ace Hotel, SoHo House, The Hoxton, and The Standard.

The trend is in its infancy but increasingly being taken up in Australia, with some global brands already in operation or soon to debut. For example, MarriottŌĆÖs W Hotels have four properties in the country (one of them under construction), AccorŌĆÖs 25hours, Ace Hotels, and BWHŌĆÖs Aiden are building one property each in Sydney, and IHGŌĆÖs Hotel Indigo is developing one property in Adelaide. Local Australian brands are also growing, such as The Calile Hotel from TOGA Group in Brisbane.

Considerations for Businesses with Millennial Customers

Lessons can be learned from lifestyle hotel brands, and other industries are launching specific brands and adjusting their business models and marketing strategies to cater to the increasingly relevant millennial sector. For example, many financial services institutions have launched millennial targeted products, such as WestpacŌĆÖs Life or BoQŌĆÖs Fast Track high-interest savings bank accounts (for customers aged up to 29 and 24 years old, respectively). Other brands are leveraging the fact that millennials are more likely to be involved with call-to-action organisations or align themselves with experiences and causes. For example, quick-service restaurants are increasingly incorporating healthier and plant-based options in their menus, with GrillŌĆÖd, Hungry JackŌĆÖs, Oporto, and KFC now offering vegan options. Also, many brands are attentively monitoring trends in social media and incorporating them into their marketing, such as support of the BLM movement or specific Pride month campaigns. In summary, to better capture the millennial segment, companies are:

- Considering specific customer needs and preferences from millennials when designing new offerings (e.g., selling experiences instead of products)

- Building a strong online presence, optimising for mobile, and pushing for user-generated content

- Building brand reputation and getting involved with social causes

- Cross-collaborating with influencers and other companies.

If you would like to know more about how Mainsheet is helping companies in hospitality or reviewing your business model and value proposition to accommodate needs from different customer segments, please get in touch with us here.

Notes:

- Millennials defined as 25ŌĆō40-year-olds (born between 1981 and 1996 as at 2021)

- Excludes domestic day travellers (e.g., no accommodation required)

- Refers to average of last 4 years to 2020 annualised (CY17 to CY20)

Sources: Australian Bureau of Statistics (ABS), Tourism Research Australia (TRA), Macquarie Research.