Preparing for Change Following the Royal Commission into Aged Care

Since Mainsheet’s inception, our team has worked closely with aged care providers to navigate the constantly evolving regulatory and operating environment. The Royal Commission into Aged Care Quality and Safety, along with its 148 recommendations for the industry, proves that the only constant in the aged care industry is change.

The primary theme of the recommendations builds on the notions of Consumer-Directed Care; to give elderly Australians as much control and choice over the services they receive as possible, while putting in place processes to ensure they will be appropriately and safely cared for.

However, these recommendations (if adopted) heighten the pressure on aged care providers that are already under duress. There is uncertainty over whether the Government will choose to adopt any or all of the recommendations, and if adopted, the timing of implementing the Commission’s recommendations. We are likely to get a better understanding from the Government at the Federal Budget announcement later in 2021.

The issue of how providers (of which the majority are still not-for-profit organisations) are meant to fund any operational changes is still relevant, as the Government will not be able to keep up with aged care expenditure unless further measures are undertaken, as discussed in the Final Report: “Aged care expenditure is projected to grow at a significantly faster rate than overall Australian Government expenditure due to projected demographic changes and subsequent increasing demand for aged care services.”

Some key takeaways:

- The Aged Care Act 1997 (Cth) should be replaced with a

new Act to come into force by no later than 1 July 2023. The new Act will

redefine Aged Care, protect and advance the rights of older people and ensure

the safety, health and wellbeing of people receiving aged care. - A new aged care program will be established that

combines the existing Commonwealth Home Support Programme, Home Care Packages

Program, and Residential Aged Care Program, including Respite Care and

Short-Term Restorative Care. - Stronger governance of the aged care system will be

established through, amongst others, the new Australian Aged Care Commission

(by July 2023), an independent office of the Inspector-General of Aged Care, an

independent Aged Care Safety and Quality Authority, an Aged Care Pricing

Authority and new Standards. - Establishment of a national registration scheme for

personal care workforce with mandatory minimum qualifications, ongoing training

requirements, minimum levels of English language proficiency and criminal

history screening requirements. - The Commissioners have offered two ways to fund these

changes, either through the introduction of an Aged Care Improvement Levy – a

flat rate of 1% on personal incomes – introduced by July 2022, or by

establishing a hypothecated aged-care levy through the taxation system that can

only be spent on aged care.

What does it mean for providers?

Now, more than ever, we believe adaptability and scalability are the two key features of a successful aged care service provider, whilst always keeping the client at the centre of any business decision.

Adaptability

In the short term we believe that providers should ready themselves for a prolonged period of change. The recommendations (should they be adopted) span multiple years and will present ongoing demands on providers to stay current and respond to any new legislation or regulation that is coming.

Having a good understanding of which of the changes are relevant for your organisation and which might have the largest impact would be a good place to start to allow for adequate planning and resourcing as the announcements are made.

Consideration should be given to how your organisation is organised, what your service models are and how these might change. Can you move to a more flexible or customer centric model now? What would need to change?

Scalability

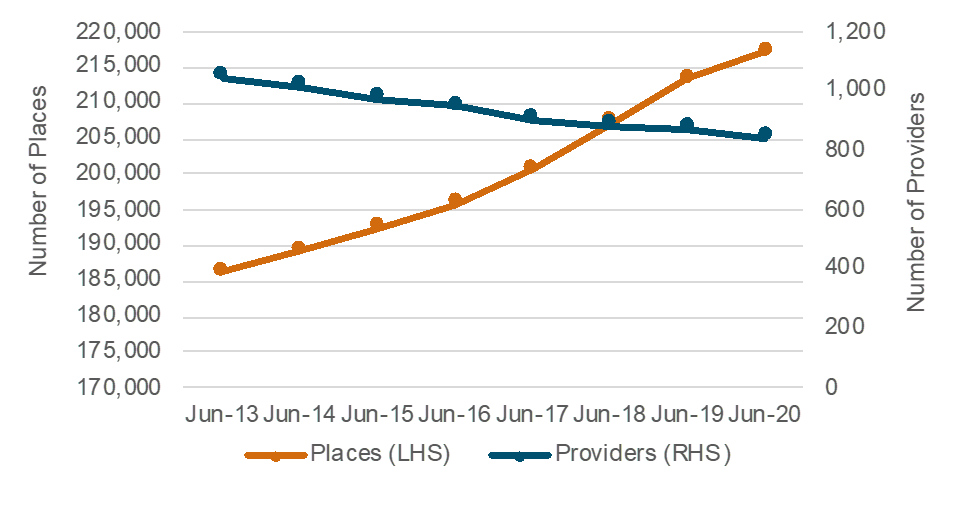

In recent years, there have been noticeable trends of consolidation in the aged care industry (particularly in the residential care sector) as smaller providers have been less able to survive challenges such as rising labour costs and slow revenue growth.

Residential Providers and Packages – National

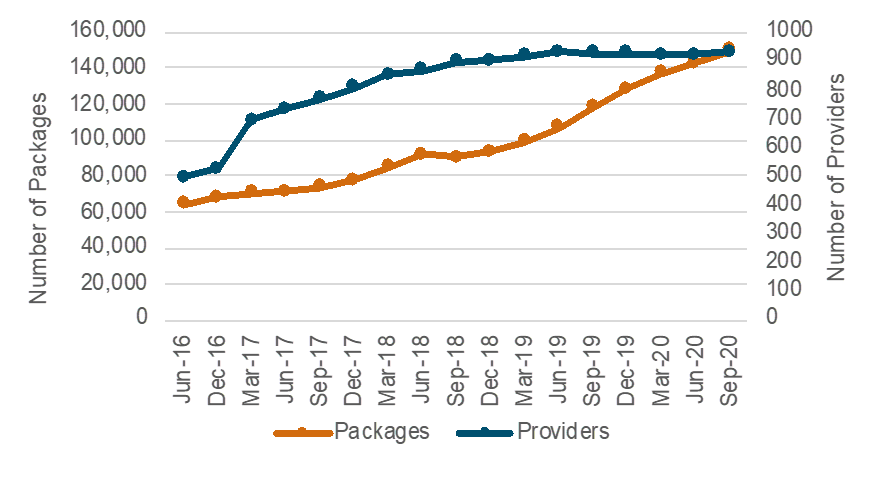

The home care market is going through a different stage of maturity, with strong growth of both providers and customers in the four years to December 2019, when the number of providers began to stagnate and decline. We believe this trend of consolidation will continue in the home care market as earnings for home care providers are declining under the pressure of increased competition and costs (as well as regulatory changes such as the introduction of online pricing transparency).

Home Care Providers and Places – National

Despite recent consolidation in the sector, there is still a long tail of small residential and home care providers. As of June 2020, 50% of providers of residential care only operate one facility, and 30% of providers account for 80% of total residential beds available.

Through economies of scale, larger providers have generally been able to survive regulatory changes in the sector, however scale alone won’t guarantee financial sustainability, nor the provision of acceptable standards of care.

How can Mainsheet Assist?

We believe a combination of scalability and adaptability in an aged care provider creates a strong foundation for the uncertainty that providers will face over the next two years. Mainsheet has considerable experience in assisting clients in the aged care industry, from redesigning service models, rostering, pricing updates, managing Royal Commission and COVID-responses, as well as M&A scanning and transactions.

If you would like to discuss these or other requirements you may have then please contact us here.