-

October 25, 2022 By :Shane McEwen

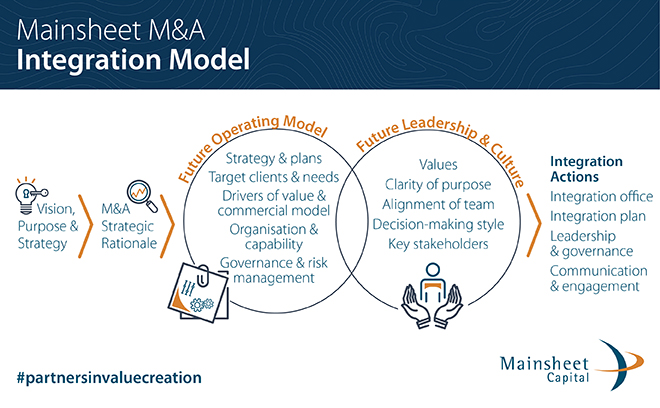

October 25, 2022 By :Shane McEwenMergers and acquisitions can offer a tremendous opportunity for achieving a company’s vision and strategic goals, but they can also be highly disruptive. To deliver the promised value, substantial changes to the merged organisation’s operating model are often necessary, even if the intent is for it to operate as a standalone subsidiary. Overall M&A Performance […]

Read More -

April 11, 2022 By :Shane McEwen

April 11, 2022 By :Shane McEwenLong-Term Value Creation Through M&A

When it comes to creating value from M&A, our analysis identified that companies are more likely to realise value over the longer term. We continue our series reviewing the financial performance of businesses following M&A activity by taking a more in-depth longer-term view of value creation. While the possibility for M&A to reduce the value […]

Read More -

November 8, 2021 By :Stephen D'Alessandro

November 8, 2021 By :Stephen D'AlessandroTaking a Longer-Term View at M&A Performance

When it comes to creating value from M&A, those companies that pursue multiple small- to medium-sized deals have a better chance of succeeding in the longer term. We continue our series reviewing the financial performance of businesses following M&A activity by taking a longer-term view of potential value creation. While the potential for M&A to […]

Read More -

July 12, 2021 By :Stephen D'Alessandro

July 12, 2021 By :Stephen D'AlessandroIs M&A Creating or Destroying Your Value?

Despite the impact of the COVID-19 pandemic, mergers and acquisition (M&A) levels have rapidly escalated in Australia. According to the AFR, FY2020 M&A activity was up 50% on FY2019. The challenges resulting from COVID-19 have resulted in hardship for many companies, yet the crisis has also incentivised companies to reset strategically. M&A is one such […]

Read More -

March 5, 2021 By :Stephen D'Alessandro

March 5, 2021 By :Stephen D'AlessandroHow do you maximise value from mergers and acquisitions? Conclusions we have drawn from reviewing 387 Australian transactions completed in the last 3 years are supplemented by our learnings from strategy, M&A and integration client projects. Following our January 2020 report on Australian M&A performance, we reviewed the one-year performance post-deal for 178 acquisitions completed […]

Read More -

June 26, 2020 By :Stephen D'Alessandro

June 26, 2020 By :Stephen D'AlessandroWhy is there consistent underperformance post-acquisition? Following our June 2019 report on the performance of M&A in Australia, we have reviewed 149 acquisitions throughout Australia that were completed during CY2018. We review transaction performance a year post-deal. We found that 72% of acquirers underperformed the benchmark, (ASX300), one year from the closing date of their […]

Read More -

July 29, 2019 By :Stephen D'Alessandro

July 29, 2019 By :Stephen D'AlessandroFollowing our March report on the performance of M&A in Western Australia, we have reviewed 93 acquisitions throughout Australia that were completed during FY2018. We found that 58% of acquirers underperformed the benchmark, the ASX300, one year from the closing date of their respective acquisition, which is consistent with the findings reported in our previous […]

Read More -

May 23, 2019 By :Stephen D'Alessandro

May 23, 2019 By :Stephen D'AlessandroOur article earlier this year analysing 2017 acquisitions showed that the old adage “~70% of acquisitions fail to add value” still proves true today. Yet when done right it can transform businesses and add shareholder value. Will your next acquisition be part of that 70%? What can you can you do to make sure you’re […]

Read More