East Coast Energy Crisis

As part of our role supporting clients to secure electricity supply on the National Electricity Market (NEM), Mainsheet conducted an analysis of the unprecedented period of high prices of electricity.

Note: Prices on the NEM have materially improved since writing this report. This analysis was first conducted in June based on the period of April – June 2022.

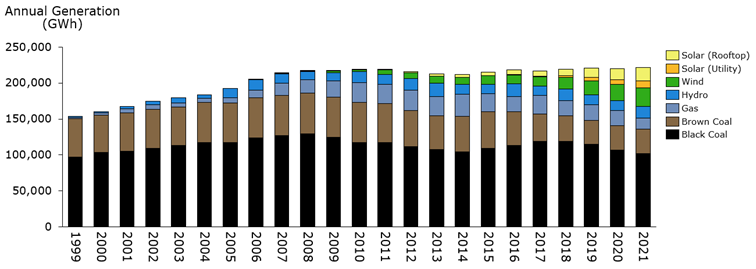

The NEM is the electricity market covering the east and south-east coast of Australia. It contains 5 regions – Queensland, New South Wales (including the ACT), Victoria, Tasmania, and South Australia – and represents approximately 85% of electricity generation in Australia. The grid is rapidly transitioning from a centralised coal-fired generation system to a highly decentralised and diverse portfolio dominated by renewable energy generators.

NEM Generation Profile – Entire Network

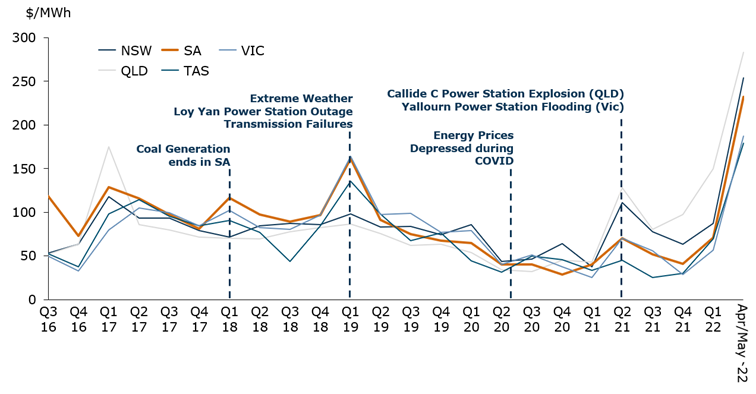

For the past 6 years, South Australian market prices have been trending lower, however in April/May/June there was a spike to record highs of 2-3x higher than historical averages of ~ $100/MWh (often over $1,000/MWh).

Average Wholesale Electricity Spot Price by Region

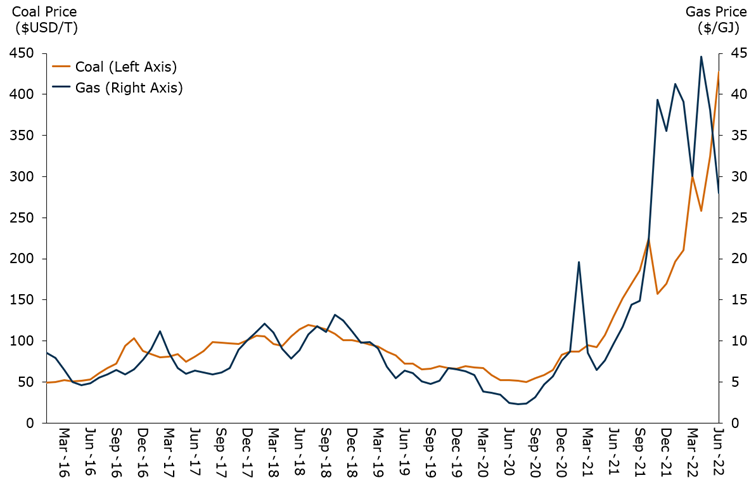

Despite the significant volume of renewable generation on the NEM (extremely high in South Australia and Tasmania), renewable generation frequently cannot fulfil all demand for a given period. For this reason, thermal generators (coal and gas) fill that gap and as the marginal bid are often the price setters across the NEM. In South Australia they set pricing approximately 60% of the time despite the preponderance of renewable generation on that grid. During this period of high prices, thermal generators were bidding into the market at 2-3x higher than historical averages, driven mostly by the price of the underlying fuels reaching all-time highs.

Historical Gas & Coal Prices

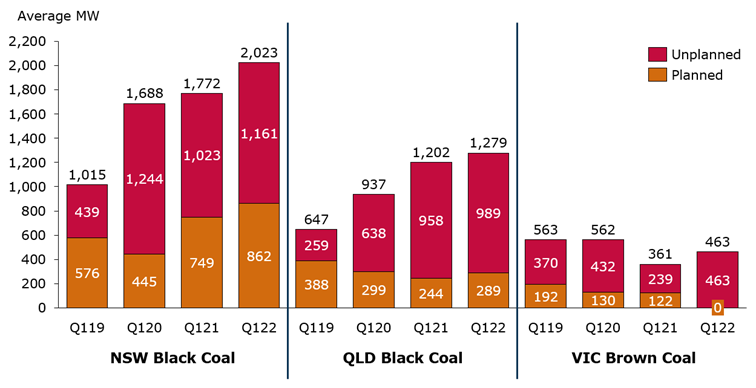

The high pricing is compounded further by record levels of unplanned thermal generator outages and a potential moral hazard whereby thermal generators profit from market chaos.

Coal Outages – First Quarter of Each Year

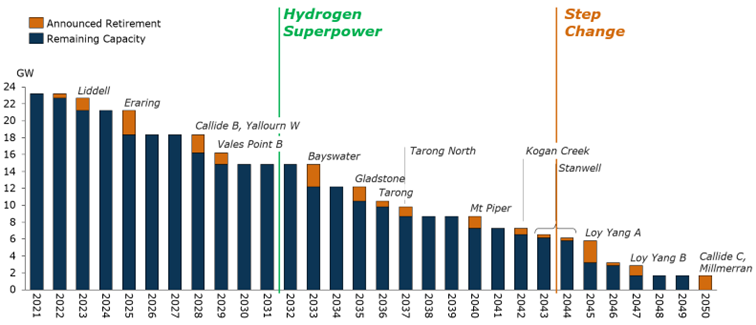

Uncertainty also exists in the mid to longer term regarding planned closure of coal generators with AEMO forecasting they will exit 2-3x faster than officially announced. As these plants exit, there is a short-term price spike from the “missed” supply, before renewable generation capacity comes online to replace it (and ultimately lower prices to below the pre-closure prices).

Announced Coal Retirement Schedule with Possible Increases

Decarbonisation across the NEM and SA is occurring faster than previously anticipated. There is a large pipeline of low-cost renewable projects announced across the NEM. Additionally, the SA-NSW interconnector is expected to be complete in late 2024, further enabling import/export between the renewable-rich grid in South Australia and the coal-dominated New South Wales grid. It will also further expose SA to the market volatility caused by NSW coal plant closures.

While the NEM’s transition to renewable energy is driving prices lower over the long-term, teething issues brought about by this transition has combined with the international energy crisis to create a perfect storm of record pricing and uncertainty. On the NEM, thermal generation continues to play a role in meeting any demand not met by renewables. The continued addition of large-scale renewables can lessen the frequency of this provided they outpace the rate of thermal generator closures, however, until thermal generation exits the NEM completely, electricity prices on Australia’s largest grid will continue to be significantly influenced by thermal generation activity and therefore the cost of the underlying fossil fuels, regardless of the significant (and increasing) volume of renewable generation.

If you would like to discuss further, please contact us here.