Creating Value From Demergers

In the pursuit of sustainable growth and value creation, an organisation’s corporate portfolio strategy is much like a fine balancing act. It requires focus on both diversifying into new sectors, geographies and capabilities to accelerate growth and maximise synergies, while also maintaining and growing core competencies and business units.

Investing too much time and capital on either side of this spectrum may reduce value creation potential. In the case of listed companies, this may happen due to:

- Lack

of management focus on a particular business unit; - Insufficient

capital investment in de-prioritised business units; - Divergent

business lifecycles, customer needs, and strategies; and - Difference

in market attractiveness of business units (due to different business models,

or ESG concerns relating to carbon emissions, gaming, etc.)

To capture and unlock this value, companies have historically sought to divest business units through demergers (alongside IPOs and trade sales).

In the past year, the ASX has seen a wave of major demerger announcements, such as:

- Woolworths

(ASX:WOW): Demerger of the ~$11bn retail drinks and hospitality business,

Endeavour (ASX:EDV) - AGL

(ASX:AGL): Separation of its low-carbon retail and trading business, New AGL,

and its large-scale electricity generator, PrimeCo - Iluka

Resources (ASX:ILU): Demerger of the ~$2bn commodities royalties business,

Deterra Royalties (ASX:DRR).

While these specific demergers have been motivated by a variety of factors including pursuit of divergent growth strategies, optimisation of capital allocation, and segregation of ESG concerns – the underlying rationale has always been to maximise value creation for shareholders.

To this effect, there is a significant body of research from academics, financial institutions, and advisers to suggest that demergers on the ASX appear to result in higher value creation for shareholders in the longer term as compared to the S&P ASX200[1].

What is a demerger?

In a demerger, a business unit is carved out from the parent entity and listed separately on the stock exchange. The separate entity has its own management team, corporate structure, stock exchange listing and balance sheet. In the case of a complete demerger, shareholders in the parent entity are given shares in 100% of the demerged entity. In this instance, shareholders effectively receive a direct shareholding in an entity in which they previously held an indirect interest.

How can demergers create value?

Key reasons for conducting a demerger to unlock value may include:

- Enabling

each entity to focus on their own core competencies; - Aligning

management incentives with the entity’s performance goals (as opposed to the

larger conglomerate’s); - Providing

the optimal capital structure for each entity and their respective business and

operating model; - Providing

greater transparency to the market to enable a fair pricing of each entity’s

true value; - Addressing

ESG concerns which may make the parent entity unattractive to investors (e.g.,

Woolworth’s demerger of its retail drinks and hospitality business, and AGL’s

demerger of its large-scale, electricity generation business).

How have Australian demergers performed in the past few years?

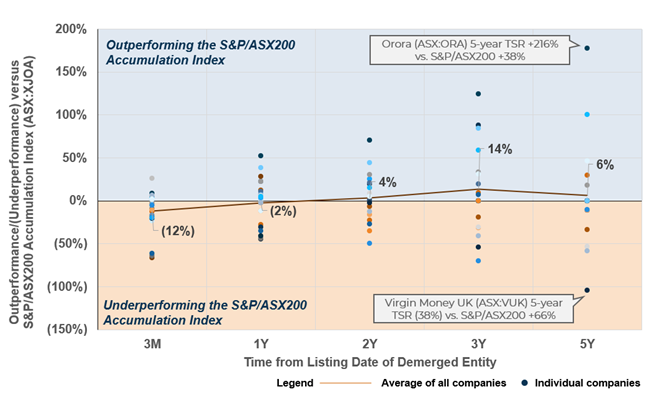

Mainsheet has analysed 13 demergers involving 26 companies since 2010 to understand the impact of historical demerger activity in Australia. As a high-level measure of value creation, Mainsheet analysed the total shareholder return following the demerger of an entity and compared it against the S&P/ASX200 Accumulation Index in the same period. However, it must be noted that the future share price and dividends of a demerged and parent entity may only partially reflect the impact of a demerger event; other events separate to the de-merger may drive under- and over-performance (e.g., acquisitions, sector performance, and unforeseen political and regulatory changes).

Mainsheet’s analysis suggests that in the short term (3 months and 1 year following listing of the demerged entity), related entities will, on average, underperform the S&P/ASX200 index. However, in periods of 2 years and 3 years following listing, the companies tend to outperform the S&P/ASX200 index, on average. This is largely consistent with historical global and Australian-focused research on demergers.

Figure 1: Total Shareholder Return Performance of select individual parent and demerged entities versus the S&P/ASX200 Accumulation Index since 2010

However, as shown in Figure 1, performance is mixed – while many demergers are successful in creating value for shareholders, many others are not.

For example, in Amcor’s 2013 demerger of Orora, shareholders were issued one Orora share for each Amcor share they owned. On the first day of listing in December 2013, Orora shares closed at $1.53 – 5 years later in 2018, Orora shares were trading at $4.08, in addition to issuing $0.465 of dividends along the way.

Yet in the case of NAB’s 75% demerger of Clydesdale Bank (now renamed Virgin Money UK) in February 2016, NAB’s share price declined from $26.87 to $24.24 in 5 years, while Virgin Money UK’s share price fell from $4.00 to $2.46 in 5 years.

Whether a demerger creates value for shareholders is dependent on the rationale, execution and implementation of a demerger.

What do Boards and Executive Management need to consider to ensure value creation?

In Mainsheet’s experience, there are a few critical decisions across the demerger process which must be considered by Boards and Executive Management to successfully create value, including:

- Is

a demerger the most appropriate option to unlock value (as compared to an IPO,

trade sale, partial demerger, etc.)? - What

are the growth strategies to deliver value for the new entities? - How

will any existing shared assets / agreements be treated in a post-demerger

scenario (including any sources of tension)? - What

is the optimal capital structure for the new entities? - What

is the appropriate level of capital expenditure for the new entities? - What

operating structure (people, processes, systems) will best enable the new

entities? - How

will the change to people and culture be managed as effectively as possible? - What

are the tax implications for shareholders?

How can Mainsheet assist?

Mainsheet has demonstrable experience in assisting companies and executives with demergers, and more broadly, in undertaking business reviews. For companies seeking to undertake a demerger or business separation, Mainsheet can assist in a number of ways, including:

- Assisting companies in understanding strategic value creation options;

- Reviewing portfolio performance and future value creation prospects;

- Assisting with the sale of divisions and assets to create renewal of the corporate portfolio;

- Assisting businesses to develop strategic growth plans substantiated by a detailed fact base to maximise value creation;

- Restructuring or refinance debt facilities, considering the various debt funding solutions and financiers in the market;

- Developing a capital investment plan to support growth initiatives;

- Assisting with the development of a post-separation operating structure.

If you would like to have a discussion around demergers and other options to unlock and create value for your current business needs and circumstances, please contact us here.

[1] Chai D, Lin Z, Veld C. Value-creation through spin-offs: Australian evidence. Australian Journal of Management. 2018;43(3):353-372., Anslinger, P. Doing the spin-out. McKinsey Quarterly. 2000;1:98-105