Is M&A Creating or Destroying Your Value?

Despite the impact of the COVID-19 pandemic, mergers and acquisition (M&A) levels have rapidly escalated in Australia. According to the AFR, FY2020 M&A activity was up 50% on FY2019.

The challenges resulting from COVID-19 have resulted in hardship for many companies, yet the crisis has also incentivised companies to reset strategically. M&A is one such way that companies are choosing to reset and focus on transformation in this post-pandemic world.

However, while transactions are on the agenda for many Australian companies, reaping the expected benefits from any deal is challenging under the best of circumstances. Our research shows that 57% of acquisitions underperform their industry benchmark three years post-deal rather than outperforming it. More than ever, having a well-defined M&A strategy, being disciplined in deal execution, and having a considered and well implemented post-merger integration plan will remain key to a successful transaction.

Two-Year Performance

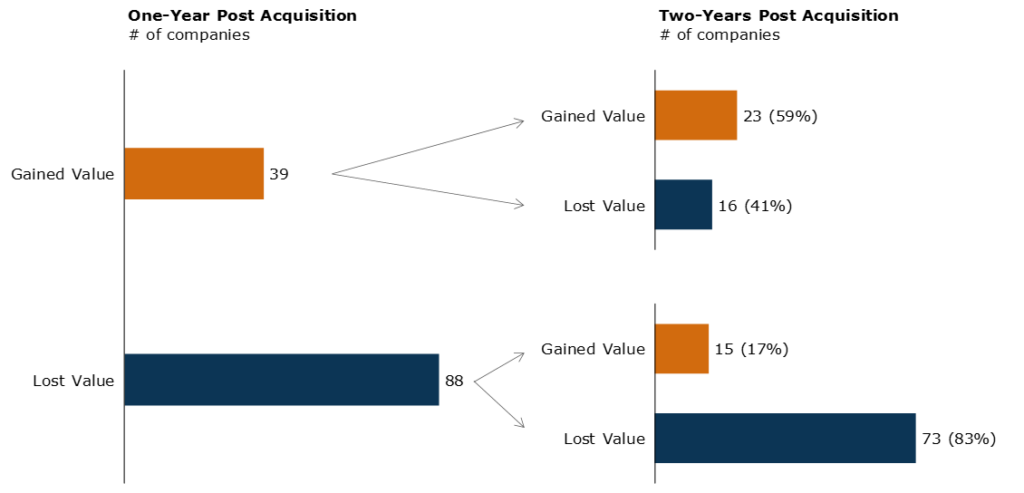

We examined the two-year performance of 127 acquisitions finalised during CY2018 and reviewed performance against their respective industry across the following two-year period. Overall, we found that only 59% of those acquirers that outperformed their industry peers one-year post-merger were able to sustain this position beyond a two-year horizon (see Figure 1).

Figure 1: Acquirer Performance Relative to Industry Peers One- and Two- Years Post Deal

Three-Year Performance

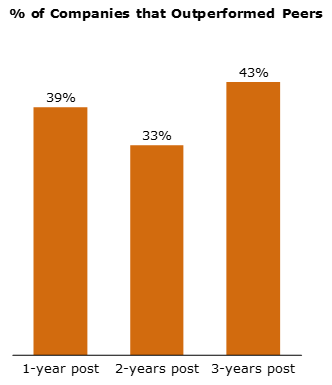

We examined the performance of 349 companies that completed acquisitions between CY2018 and CY2020. In general, our research thus far suggests that an acquisition is more likely to create value three years post-acquisition than one year post (see Figure 2). However, it remains that the majority of companies fail to deliver value post-merger.

Figure 2: One-, Two- and Three-year post Deal Acquirer Performance

This analysis raises several questions:

- Are companies pursuing

acquisitions to implement a strategy, or reacting opportunistically? - Are acquirers more focussed on

making a deal happen in the short term instead of making decisions focused on

creating long-term value? - What consideration is being given

to selecting acquisition targets based on strategic acquisition criteria? - What emphasis is being placed on

alignment of vision, values, culture and leadership behaviours? - Are acquirers and acquired

companies engaging in joint strategic planning of the new combined business? - Are firms able to retain key

personnel following a transition? - To what extent are acquiring

companies proactively managing the complexity involved in integration and

capturing the value of synergies?

Maximising the Likelihood of Long-Term Success

Building an Acquisition Strategy Fit for the Post-Pandemic World

Being clear on a deal’s strategic rationale and strategy is critical for both pre-and post-merger activities. A precisely defined purpose will help build a clear understanding of the specific outcomes you want to achieve and how you will achieve them in a period of unforeseeable disruptions. Mainsheet can help firms with strategy development, M&A strategy and deal searches, including expansions into new geographic regions and manufacturing capabilities. If you are thinking of commencing or improving your M&A process, please contact us for a conversation.

Following a Comprehensive Integration Model

Now more than ever, a carefully designed post-merger integration plan is crucial for success. Every M&A deal presents unique benefits and challenges, and these complexities have grown in recent times because of the COVID-19 crisis. By leveraging and tailoring our standardised collection of processes, templates and protocols, we can help our clients commit to a structured integration program to set up their integrated business for long term value creation.

If you want to talk about these or other questions, please contact us here.